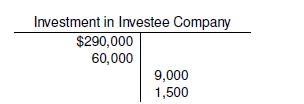

The following T-account shows various transactions using the equity method. This investment of $290,000 is made up

Question:

The following T-account shows various transactions using the equity method. This investment of $290,000 is made up of 30% of the outstanding shares of another company who had a carrying amount of $900,000. The excess of the purchase price over the investment amount is attributable to capital assets in excess of the carrying values with the remainder allocated to goodwill. The investor company has significant influence over the investee company. Dividends for 15% of the investee’s net income are paid out in cash annually.

The investee’s net assets have a remaining useful life of 10 years. The investor company follows IFRS.

Required:

a. What was the investee’s total net income for the year?

b. What was the investee’s total dividend payout for the year?

c. What is the investor’s share of net income?

d. How much was the investor’s annual depreciation of the excess payment for capital assets?

e. How much of the excess payment would be assigned to goodwill?

f. How much are the investor’s share of dividends for the year?

Step by Step Answer:

Intermediate Financial Accounting Volume 1

ISBN: 9781539980674

1st Edition

Authors: Glenn Arnold, Suzanne Kyle, Lyryx Learning