On January 1, 2019, Dologan Enterprises Ltd. purchased 30% of the common shares of Twitterbug Inc. for

Question:

On January 1, 2019, Dologan Enterprises Ltd. purchased 30% of the common shares of Twitterbug Inc. for $380,000. These shares are not traded in any active markets. The carrying value of Twitterbug’s net assets at the time of the shares purchase was $1.2 million. Any excess of the purchase cost over the investment is attributable to unrecorded intangibles with a 10-year life.

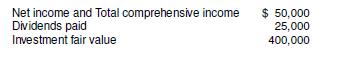

During 2019, the following summary operations for Twitterbug occurred:

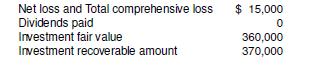

During 2020, the following summary operations for Twitterbug occurred:

Required:

a. Prepare all the relevant entries for 2019 and 2020 assuming no significant influence.

Assume that Dologan follows IFRS and accounts for the investment as a FVNI.

b. How is the comprehensive income affected in 2019 and 2020 in part (a)?

c. Prepare all the relevant entries for 2019 and 2020 assuming that Dologan can exercise significant influence. Assume that Dologan follows IFRS.

d. Calculate the carrying value of the investment as at December 31, 2020 assuming Dologan can exercise significant influence and follows IFRS.

e. How would your answer to part

(c) be different if Twitterbug’s statement of comprehensive income included a loss from discontinued operations of $15,000 (net of tax)

for 2019?

Step by Step Answer:

Intermediate Financial Accounting Volume 1

ISBN: 9781539980674

1st Edition

Authors: Glenn Arnold, Suzanne Kyle, Lyryx Learning