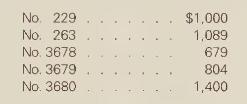

The outstanding checks of Brothers Company at November 30, 1999, were: During December, Brothers issued checks numbered

Question:

The outstanding checks of Brothers Company at November 30, 1999, were:

During December, Brothers issued checks numbered 3681-3720; and all of these checks cleared the bank except 3719 and 3720 for \(\$ 963\) and \(\$ 726\), respectively. Checks 3678,3679 , and 3680 also cleared the bank.

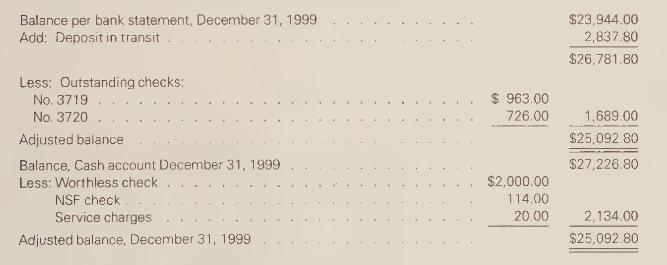

The bank statement on December 31 showed a balance of \(\$ 23,944\). Service charges amounted to \(\$ 20\), and two checks were returned by the bank, one marked NSF in the amount of \(\$ 114\) and the other marked "No account" in the amount of \(\$ 2,000\).

Brian Askew recently retired as the office manager-cashier-bookkeeper for Brothers Company and was replaced by Fred Hannah. Hannah noted the absence of an internal control structure but was momentarily deterred from embezzling for lack of a scheme of concealment. Finally, he hit upon several schemes. The \(\$ 2,000\) check marked "No account" by the bank is the product of one scheme. Hannah took cash receipts and replaced them with a check drawn on a nonexistent account to make it appear that a customer had given the company a worthless check.

The other scheme was more subtle. Hannah pocketed cash receipts in an amount equal to two unlisted outstanding checks and prepared the following bank reconciliation:

a. State the nature of the second scheme hit on by Hannah. How much in total does it appear he has stolen by use of the two schemes together?

b. Prepare a correct bank reconciliation as of December 31, 1999 .

c. After your analysis in

(a) and (b), describe several procedures that would have defeated Fred Hannah's attempts to misappropriate funds and conceal these actions.

Step by Step Answer:

Financial Accounting A Business Perspective

ISBN: 9780072289985

7th Edition

Authors: Roger H. Hermanson, James Don Edwards