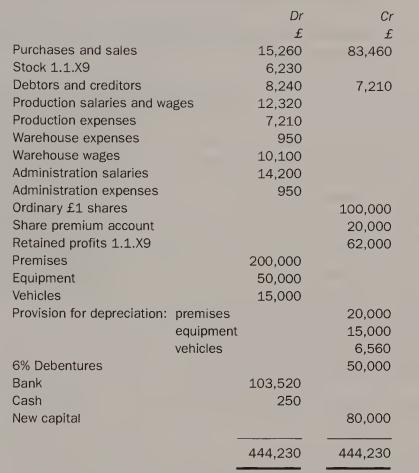

The trial balance of Burn Ltd. as at 31.12.X9 was as follows: The following additional information is

Question:

The trial balance of Burn Ltd. as at 31.12.X9 was as follows:

The following additional information is available none of which has been accounted for in the trial balance:

Stock 31.12.X9 £4,560 Premises and equipment are used 50% production, 25% distribution and 25% administration and are depreciated at the rate of 2% and 10%

respectively.

Vehicles are only used by distribution and are depreciated at 25%

reducing balance A provision for bad debts of 5% is to be made A final dividend of 5p per share is proposed on all share capital in issue The new capital consists of the issue on 1.12.X9 of 40,000 £1 shares, the ledger clerk did not know how to treat this item in the ledgers Tax for the year is estimated at £1,200 A vehicle, purchased 1.1.X7 for £7,000 was sold on 1.8.X9 for £3,750.

The proceeds had been credited to sales 5% Debentures were issued on 1.1.X9, par value £10,000, for £9,500. ^

The £9,500 has been credited to retained profits 1.1.X9 account.

Prepare the profit and loss account and the balance sheet for Burn Ltd. as at 31.12.X9 in a form suitable for publication.

Answers to these questions can be found at the back of the book.

Further review questions are available in a separate resource pack which is avail¬

able to lecturers.

Step by Step Answer:

Financial Accounting Longman Modular Texts In Business And Economics

ISBN: 9780582381698

2nd Edition

Authors: Christopher Waterston, Anne Britton