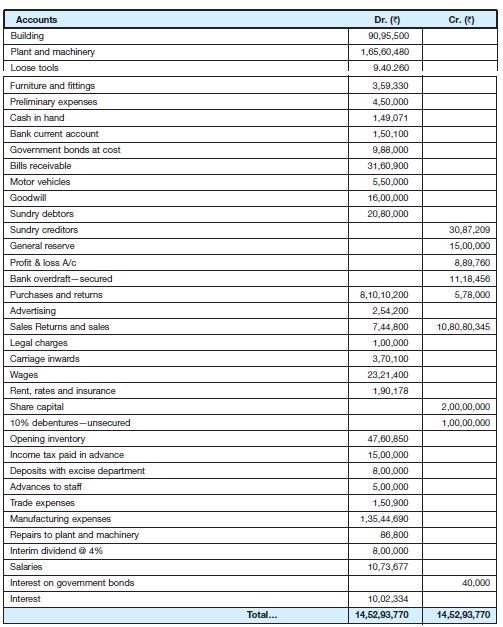

The trial balance of Hindustan Textiles Ltd. as at 31st March 2006 is as presented hereunder. Further

Question:

The trial balance of Hindustan Textiles Ltd. as at 31st March 2006 is as presented hereunder.

Further information

1. The authorized capital of the company is 30 lakh equity shares of ₹10 each of which 25 lakh shares have been issued. ₹8 per share has been called up.

2. Preliminary expenses to be w/o ₹1,50,000.

3. Depreciation to be charged:

n Building @ 10%

n Plant and machinery @ 14%

n Furniture and fittings @ 18%

n Motor vehicles @ 20%

4. Goodwill to be amortised ₹4,00,000.

5. The closing stock of loose tools is valued at ₹7,30,210.

6. Face value of government bonds is ₹10,00,000. They carry interest @ 8% per annum.

7. The closing inventory is valued at ₹54,20,310.

8. Provide for bad debts @ 5%.

9. Interest includes that on debentures for 9 months.

10. Provide income tax @ 35%.

11. A final dividend of 6% is recommended by the board of directors.

Required

1. Prepare the following financial statements of Hindustan Textiles Ltd.:

a. Balance sheet as at 31st March 2006.

b. Profit and loss account for the year ended 31st March 2006.

c. Profit and loss appropriation account for the year ended 31st March 2006.

2. Briefly comment upon the performance of the company.

Step by Step Answer: