1.. Starstruck Company would like to determine its optimal capital structure. Several of its managers believe that...

Question:

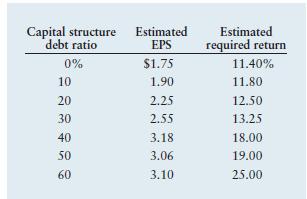

1.. Starstruck Company would like to determine its optimal capital structure. Several of its managers believe that the best method is to rely on the estimated earnings per share (EPS) of the firm because they believe that profits and stock price are closely related. The financial managers have suggested another method that uses estimated required returns to estimate the share value of the firm. The following financial data are available

To Do

a. Based on the given financial data, create a spreadsheet to calculate the estimated share values associated with the seven alternative capital structures. Refer to Table 12.15.

b. Use Excel to graph the relationship between capital structure and the estimated EPS of the firm. What is the optimal debt ratio? Refer to Figure 12.7.

c. Use Excel to graph the relationship between capital structure and the estimated share value of the firm. What is the optimal debt ratio? Refer to Figure 12.7.

d. Do both methods lead to the same optimal capital structure? Which method do you favor? Explain.

e. What is the major difference between the EPS and share value methods?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9780133546408

7th Edition

Authors: Lawrence J Gitman, Chad J Zutter