At the end of 2012, Uma Corporation was considering undertaking a major long-term project in an effort

Question:

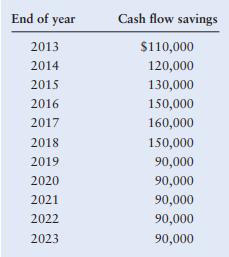

At the end of 2012, Uma Corporation was considering undertaking a major long-term project in an effort to remain competitive in its industry. The production and sales departments determined the potential annual cash flow savings that could accrue to the firm if it acts soon. Specifically, they estimate that a mixed stream of future cash flow savings will occur at the end of the years 2013 through 2018. The years 2019 through 2023 will see consecutive and equal cash flow savings at the end of each year. The firm estimates that its discount rate over the first 6 years will be 7%. The expected discount rate over the years 2019 through 2023 will be 11%.

The project managers will find the project acceptable if it results in present cash flow savings of at least $860,000. The following cash flow savings data are supplied to the finance department for analysis.

TO DO

Create spreadsheets similar to Table 5.2, and then answer the following questions:

a. Determine the value (at the beginning of 2013) of the future cash flow savings expected to be generated by this project.

b. Based solely on the one criterion set by management, should the firm undertake this specific project? Explain.

c. What is the “interest rate risk,” and how might it influence the recommendation made in part b? Explain.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 978-0136119463

13th Edition

Authors: Lawrence J. Gitman, Chad J. Zutter