CBA Company is considering two mutually exclusive projects, A and B. The following table shows the CAPM-type

Question:

CBA Company is considering two mutually exclusive projects, A and B. The following table shows the CAPM-type relationship between a risk index and the required return (RADR) applicable to CBA Company.

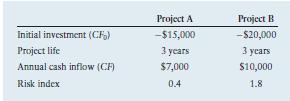

Project data are as follows:

a. Ignoring any differences in risk and assuming that the firm’s cost of capital is 10%, calculate the net present value (NPV) of each project.

b. Use NPV to evaluate the projects, using risk-adjusted discount rates (RADRs) to account for risk.

c. Compare, contrast, and explain your findings in parts a and b.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted: