Determine the total taxes payable, with a 20% tax rate, for each of the following situations. The

Question:

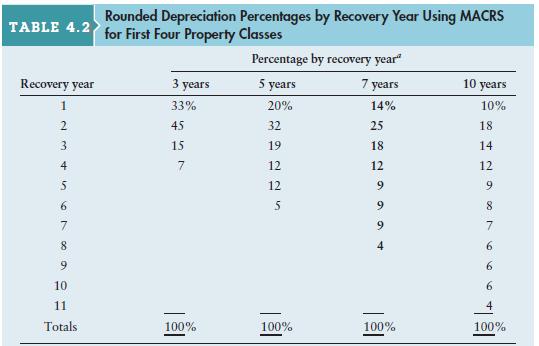

Determine the total taxes payable, with a 20% tax rate, for each of the following situations. The asset was purchased 5 years ago for $460,200 and is being depreciated under MACRS using a 7-year recovery period. (See Table 4.2 on page 166 for the applicable depreciation percentages. Round answers to the nearest whole dollar.)

Table 4.2:

a. The asset is sold for $725,000.

a. The asset is sold for $725,000.

b. The asset is sold for $650,000.

c. The asset is sold for $101,244.

d. The asset is sold for $92,244.

Transcribed Image Text:

TABLE 4.2 Recovery year 1 2 3 4 56700 8 9 10 11 Totals Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes 3 years 33% 45 15 7 100% Percentage by recovery year" 5 years 7 years 20% 14% 25 18 12 32 19 225 12 12 100% 9 9 9 100% 10 years 10% 18. 14 12 9 8 7 6 6 6 100%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 80% (5 reviews)

To calculate the total taxes payable for each of the situations provided we need to determine the ga...View the full answer

Answered By

Abdul Wahab Qaiser

Before working at Mariakani, I volunteered at a local community center, where I tutored students from diverse backgrounds. I helped them improve their academic performance and develop self-esteem and confidence. I used creative teaching methods, such as role-playing and group discussions, to make the learning experience more engaging and enjoyable.

In addition, I have conducted workshops and training sessions for educators and mental health professionals on various topics related to counseling and psychology. I have presented research papers at conferences and published articles in academic journals.

Overall, I am passionate about sharing my knowledge and helping others achieve their goals. I believe that tutoring is an excellent way to make a positive impact on people's lives, and I am committed to providing high-quality, personalized instruction to my students.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted:

Students also viewed these Business questions

-

A machine currently in use was originally purchased 2 years ago for $40,000. The machine is being depreciated under MACRS using a 5-year recovery period; it has 3 years of usable life remaining. The...

-

For each of the following cases, determine the total taxes resulting from the transaction. Assume a 40% tax rate. The asset was purchased 2 years ago for $200,000 and is being depreciated under MACRS...

-

Lasting Impressions (LI) Company is a medium-sized commercial printer of promotional advertising brochures, booklets, and other direct-mail pieces. The firm's major clients are ad agencies based in...

-

The measured and corrected cylinder pressures around IVC (210CA) are given in the table. Find out the reference pressure ppeg (the manifold air pressure) at IVC, using 5 point half-width (n=10) for...

-

Although all nine of the competitive priorities discussed in this chapter are relevant to a companys success in the marketplace, explain why a company should not necessarily try to excel in all of...

-

Distinguish between job descriptions and job specifications.

-

Seventh Generations products are plant-based and designed to minimize negative environmental impacts. Seventh Generation is considering launching a new infant skin care line. Describe two possible...

-

The steps in the accounting cycle are listed in random order. Fill in the blank next to each step to indicate its order in the cycle. The first step in the cycle is filled in as an example. Order...

-

1. The city council adopted a General Fund budget for the fiscal year. Revenues were estimated at $2,000,000 and appropriations were $1,990,000. 2. Property taxes in the amount of $1,940,000 were...

-

Marco Company shows the following costs for three jobs worked on in April. Job 306 Job 307 $ 27,000 $ 41,000 22,000 11,000 16,000 8,000 Balances on March 31 Direct materials used (in March) Direct...

-

CBA Company is considering two mutually exclusive projects, A and B. The following table shows the CAPM-type relationship between a risk index and the required return (RADR) applicable to CBA...

-

MSF Manufacturing Company is considering the purchase of a new machine to improve its production efficiency. The company has total current assets amounting to $865,000 and total current liabilities...

-

For the following exercises, find the multiplicative inverse of each matrix, if it exists. 2|11|11|- 7|12|11|- 0011 1111|-

-

do you agree wih this approach to dismantling the toxic culture? explain

-

Movies When randomly selecting a speaking character in a movie, the probability of getting a female is 0.331 (based on data from "Inequality in 1200 Popular Films," by Smith, et al., Annenberg...

-

Steve Reese is a well-known interior designer in Fort Worth, Texas. He wants to start his own business and convinces Rob O'Donnell, a local merchant, to contribute the capital to form a partnership....

-

Exercise 6-10A (Algo) Double-declining-balance and units-of-production depreciation: gain or loss on disposal LO 6-3, 6-4, 6-5 Exact Photo Service purchased a new color printer at the beginning of...

-

Independent Events Again assume that when randomly selecting a speaking character in a movie, the probability of getting a female is 0.331, as in Exercise 1. If we want to find the probability of 20...

-

A spring of constant 15 kN/m connects Points C and F of the linkage shown. Neglecting the weight of the spring and linkage, determine the force in the spring and the vertical motion of Point G when a...

-

The diameter of a sphere is 18 in. Find the largest volume of regular pyramid of altitude 15 in. that can be cut from the sphere if the pyramid is (a) square, (b) pentagonal, (c) hexagonal, and (d)...

-

Ram Electric Company is being considered for acquisition by Cavalier Electric. Cavalier expects the combination to increase its cash flows by $100,000 for each of the next 5 years and by $125,000 for...

-

As the financial manager for a large multinational corporation (MNC), you have been asked to assess the firms economic exposure. The two major currencies, other than the U.S. dollar, that affect the...

-

What is operating leverage, and how does it affect a firms business risk?

-

Ventaz Corp manufactures small windows for back yard sheds. Historically, its demand has ranged from 30 to 50 windows per day with an average of 4646. Alex is one of the production workers and he...

-

Which of the following statements is not true regarding the $500 credit for dependent other than a qualifying child credit. Cannot be claimed on the same tax return if the child tax credit is also...

-

Grind Co. is considering replacing an existing machine. The new machine is expected to reduce labor costs by $127,000 per year for 5 years. Depreciation on the new machine is $57,000 compared with...

Study smarter with the SolutionInn App