Capital asset pricing model (CAPM) For each case in the following table, use the capital asset pricing

Question:

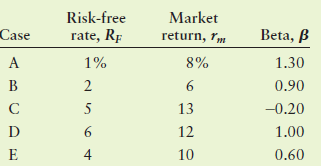

Capital asset pricing model (CAPM) For each case in the following table, use the capital asset pricing model to find the required return.

The Capital Asset Pricing Model (CAPM) describes the relationship between systematic risk and expected return for assets, particularly stocks. The CAPM is a model for pricing an individual security or portfolio. For individual securities, we make use of the security market line (SML) and its...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart

Question Posted: