Common-size statement analysis A common-size income statement for Creek Enterprises 2021 operations follows. Using the firms 2022

Question:

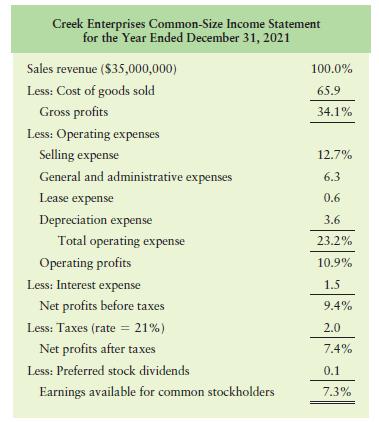

Common-size statement analysis A common-size income statement for Creek Enterprises’ 2021 operations follows. Using the firm’s 2022 income statement presented in Problem 3–16, develop the 2022 common-size income statement and compare it with the 2021 common-size statement. Which areas require further analysis and investigation?

Transcribed Image Text:

Creek Enterprises Common-Size Income Statement for the Year Ended December 31, 2021 Sales revenue ($35,000,000) Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses Lease expense Depreciation expense Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 21%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders 100.0% 65.9 34.1% 12.7% 6.3 0.6 3.6 23.2% 10.9% 1.5 9.4% 2.0 7.4% 0.1 7.3%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart

Question Posted:

Students also viewed these Business questions

-

A common-size income statement for Creek Enterprises 2011 operations follows. Using the firms 2012 income statement presented in Problem 318, develop the 2012 common-size income statement and compare...

-

Creek Enterprises' 2014 operations follows: Using the firm's 2015 income statement presented in Problem 3-18, develop the 2015 common-size income statement and compare it with the 2014 statement....

-

A common-size income statement for Creek Enterprises 2014 operations follows. Using the firms 2015 income statement presented in Problem 318 develop the 2015 common-size income statement and compare...

-

If you were able to dictate economic policy, how would you strengthen the automatic stabilizers in this country? Why would your solutions work?

-

During 2015, Toney Corporation held a portfolio of available-for-sale investments having a cost of $190,000. There were no purchases or sales of investments during the year. The market values at the...

-

Employees identified three reasons for not participating in the program at Marshalls. How would you deal with each of these problems? Is it possible (or desirable) to satisfy all groups of employees...

-

What are the major differences between the consumer buying process discussed in Chapter 6 and the B2B buying process discussed in this chapter? Use buying iPads for personal use versus buying more...

-

Greish Inc. is preparing its annual budgets for the year ending December 31, 2016. Accounting assistants have provided the following data: An accounting assistant has prepared the detailed...

-

Molander Corporation is a distributor of a sun umbrella used at resort hotels. Data concerning the next months budget appear below: Selling price per unit $ 24 Variable expense per unit $ 15 Fixed...

-

Financial information from fiscal year 2017 for two companies, Carson Sportswear and Boswell Dresses, which are competing businesses in the sportswear market in Utah, appears in the table below. All...

-

Bauman Companys total current assets, total current liabilities, and inventory for each of the past four years follow: a. Calculate the firms current and quick ratios for each year. Compare the...

-

The following comparative statements of financial position and income statement are for the business of Bargains Galore Pty Ltd. Additional information 1. All sales and purchases of inventory are on...

-

firm c has net income of 45,360 , asset turnover of 1.4 and roi 12.6% calculate firms margin,sales and average total assets

-

A poll of 1065 Americans showed that 47.2% of the respondents prefer to watch the news rather than read or listen to it. Use those results with a 0.10 significance level to test the claim that fewer...

-

Garcia Industries uses a cost system that carries direct materials inventory at a standard cost. The controller has established these standards for the cost of one unit: Standard Quantity X Standard...

-

Express the confidence interval 0.255 0.046 in the form of p-E

-

5 28 its Jay Oullette, CEO of Bumper to Bumper Incorporated, anticipates that his company's year-end balance sheet will show current assets of $12,801 and current liabilities of $7,540. Oullette has...

-

Solve the following proportions for the unknown quantities 3:4:13 = x:y:6.5

-

7 A 29-year-old, previously healthy man suddenly collapses at a party where legal and illicit drugs are being used. Enroute to the hospital, he requires resuscitation with defibrillation to establish...

-

Using a 10% cost of capital, calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. Cash flows (CF;) in thousands...

-

Using a 10% cost of capital, calculate the net present value for each of the independent projects shown in the following table, and indicate whether each is acceptable. Cash flows (CF;) in thousands...

-

Jenny Jenks has researched the financial pros and cons of entering into a 1-year MBA program at her state university. The tuition and books for the masters program will have an up-front cost of...

-

What is the Macaulay duration of a bond with a coupon of 6.6 percent, seven years to maturity, and a current price of $1,069.40? What is the modified duration? (Do not round intermediate...

-

"Tell me something you know today that you did not know yesterday" about 3D Animation Justify by citing 2 or more resources from this course.

-

Warrants exercisable at $20 each to obtain 50,000 shares of common stock were outstanding during a period when the average market price of the common stock was $25. Application of the treasury stock...

Study smarter with the SolutionInn App