Decision among mutually exclusive investments Jamis Hospitality is planning to open a new restaurant in the Netherlands.

Question:

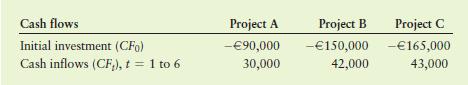

Decision among mutually exclusive investments Jami’s Hospitality is planning to open a new restaurant in the Netherlands. It has identified three different locations in Rotterdam and needs to pick one of the locations. Jami’s expects different initial investments and future cash flows for each location. The details of initial investments and future cash flows are provided in the table below.

a. Calculate the payback period for each project.

b. Calculate the net present value (NPV) of each project, assuming that the firm has a cost of capital equal to 14%.

c. Calculate the internal rate of return (IRR) for each project.

d. Draw the NPV profiles for the three projects on the same set of axes, and discuss any conflict in ranking that may exist between NPV and IRR.

e. Summarize the preferences dictated by each measure and indicate which project you would recommend. Explain why.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart