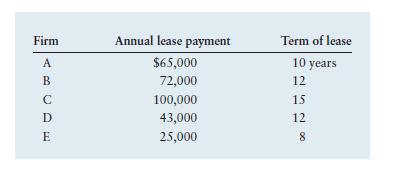

Five firms have leases with the lease payments and terms shown in the table below. Assume that

Question:

Five firms have leases with the lease payments and terms shown in the table below. Assume that no purchase option exists. Each firm is in the 40% tax bracket, and all payments are made at the end of the year. Calculate the yearly after tax cash outflows for each firm.

Transcribed Image Text:

Firm AB А с D E Annual lease payment $65,000 72,000 100,000 43,000 25,000 Term of lease 10 years 12 15 12 00 8

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 75% (8 reviews)

To calculate the yearly aftertax cash outflows for each firm we need to take into account the tax de...View the full answer

Answered By

User l_1034280

Throughout my academic journey and hands-on projects, I have accumulated a diverse range of experiences that have honed my skills as a coding, database, and Unix applications specialist. I have delved into complex coding challenges, crafting software solutions that merge functionality with efficiency. My database management expertise has been put to the test, designing and optimizing data systems that drive business intelligence and decision-making. In the realm of Unix applications, I've confidently navigated the intricate landscape of Unix-based systems, scripting automation, and ensuring robust system administration. These experiences have not only solidified my technical prowess but have also instilled in me a profound appreciation for the limitless possibilities that technology offers in solving real-world problems.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted:

Students also viewed these Business questions

-

Given the lease payments and terms shown in the following table, determine the yearly after-tax cash outflows for each firm, assuming that lease payments are made at the end of each year and that the...

-

Given the lease payments and terms shown in the following table, determine the yearly after-tax cash outflows for each firm. Assume that lease payments are made at the beginning of each year. The...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

What is the payback period? Name and discuss three possible reasons that the payback period is used to help make capital investment decisions.

-

A corporation issued $300,000 of common stock in exchange for $300,000 of fixed assets. Where would this transaction be reported on the statement of cash flows?

-

Would the NSA or other security firms want to hire hackers from Black Hat? Why or why not?

-

What pricing strategies should be considered when introducing a new product?

-

On January 1, 2007 the Stimpson Company sells land to Barker Company for $2.5 million, then immediately leases it back. The relevant information is as follows: 1. The land was carried on Stimpsons...

-

It is more beneficial for a company with a _______ amount of manufacturing overhead and a __________ product line to use activity-based costing. Group of answer choices Large/Diverse Small/Homogenous...

-

Explain the process by which a Steinway grand piano is constructed as a subsystem of a larger system. From what the text tells you, give some examples of how the production subsystem is affected by...

-

Mountain Mining Company has an outstanding issue of convertible bonds with a $1,000 par value. These bonds are convertible into 40 shares of common stock. They have an 11% annual coupon interest rate...

-

The Hot Bagel Shop wishes to evaluate two plans for financing an oven: leasing and borrowing to purchase. The firm is in the 40% tax bracket. Lease The shop can lease the oven under a 5-year lease...

-

Assume the spot price of wheat is $3.17 per bushel. The appropriate interest rate is 3 percent, and there are no storage costs. Under spot-futures parity, calculate the price for a six-month wheat...

-

According to the College Board website, the scores on the math part of the SAT (SAT-M) in a certain year had a mean of 507 and a standard deviation of 111. Assume that SAT scores follow a normal...

-

Pay and incentive programs are being used both for knowledge workers and in non-knowledge worker occupations. In every industry, from restaurants to construction and low-tech manufacturing, companies...

-

Closet International invested in an equipment in 2019 with an initial cost of $598,000. It falls under asset class 8 with a CCA rate of 20%. The equipment was sold in 2021 for $260,000. Calculate the...

-

Question 4 (30 Marks) A 12-ply Kevlar/Epoxy composite beam with layup [0/90 / 0 1s is loaded in 3-point bending, as shown in Figure Q4. The beam has a length, L of 100mm, a width, b of 25mm and a...

-

Scenario: You have been working in a community service sector for two years. However, you always find evaluating your own performance challenging. Your Supervisor has also identified that you do not...

-

The block and tackle shown are used to raise a 150-lb load. Each of the 3-in.- diameter pulleys rotates on a 0.5-in.-diameter axle. Knowing that the coefficient of static friction is 0.20, determine...

-

Use nodal analysis to determine voltages v1, v2, and v3 in the circuit Fig. 3.76. Figure 3.76 4 S 3i, 2 A 4A

-

Edison Systems has estimated the cash flows over the 5-year lives for two projects, A and B. These cash flows are summarized in the table below. a. If project A were actually a replacement for...

-

Masters Golf Products, Inc., spent 3 years and $1,000,000 to develop its new line of club heads to replace a line that is becoming obsolete. To begin manufacturing them, the company will have to...

-

Covol Industries is developing the relevant cash flows associated with the proposed replacement of an existing machine tool with a new, technologically advanced one. Given the following costs related...

-

Berbice Inc. has a new project, and you were recruitment to perform their sensitivity analysis based on the estimates of done by their engineering department (there are no taxes): Pessimistic Most...

-

#3) Seven years ago, Crane Corporation issued 20-year bonds that had a $1,000 face value, paid interest annually, and had a coupon rate of 8 percent. If the market rate of interest is 4.0 percent...

-

I have a portfolio of two stocks. The weights are 60% and 40% respectively, the volatilities are both 20%, while the correlation of returns is 100%. The volatility of my portfolio is A. 4% B. 14.4%...

Study smarter with the SolutionInn App