P1220 Debt and financial risk Tower Interiors has made the forecast of sales shown in the following

Question:

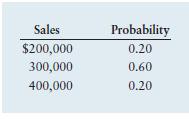

P12–20 Debt and financial risk Tower Interiors has made the forecast of sales shown in the following table. Also given is the probability of each level of sales.

The firm has fixed operating costs of $75,000 and variable operating costs equal to 70% of the sales level. The company pays $12,000 in interest per period. The tax rate is 40%.

The firm has fixed operating costs of $75,000 and variable operating costs equal to 70% of the sales level. The company pays $12,000 in interest per period. The tax rate is 40%.

a. Compute the earnings before interest and taxes (EBIT) for each level of sales.

b. Compute the earnings per share (EPS) for each level of sales, the expected EPS, the standard deviation of the EPS, and the coefficient of variation of EPS, assuming that there are 10,000 shares of common stock outstanding.

c. Tower has the opportunity to reduce its leverage to zero and pay no interest.

This change will require that the number of shares outstanding be increased to 15,000. Repeat part b under this assumption.

d. Compare your findings in parts b and

c, and comment on the effect of the reduction of debt to zero on the firm’s financial risk.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9780133546408

7th Edition

Authors: Lawrence J Gitman, Chad J Zutter