Pavlovich Instruments Inc., a maker of precision telescopes, expects to report pretax income of $430,000 this year.

Question:

Pavlovich Instruments Inc., a maker of precision telescopes, expects to report pretax income of $430,000 this year. The company’s financial manager is considering the timing of a purchase of new computerized lens grinders. The grinders will have an installed cost of $80,000 and a cost recovery period of 5 years. They will be depreciated using the MACRS schedule.

a. If the firm purchases the grinders before year’s end, what depreciation expense will it be able to claim this year? (Use Table 4.2.)

b. If the firm reduces its reported income by the amount of the depreciation expense calculated in part a, what tax savings will result?

b. If the firm reduces its reported income by the amount of the depreciation expense calculated in part a, what tax savings will result?

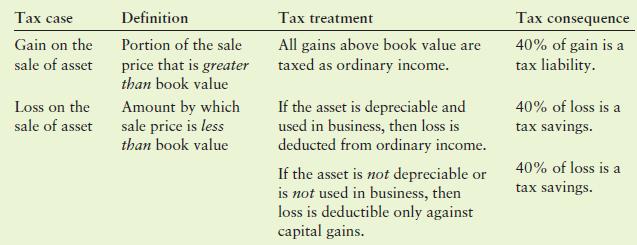

Tax case Definition Tax treatment Tax consequence 40% of gain is a tax liability. Gain on the Portion of the sale All gains above book value are taxed as ordinary income. sale of asset price that is greater than book value Loss on the Amount by which sale price is less than book value If the asset is depreciable and used in business, then loss is deducted from ordinary income. 40% of loss is a sale of asset tax savings. 40% of loss is a tax savings. If the asset is not depreciable or is not used in business, then loss is deductible only against capital gains.

Step by Step Answer:

a Depreciation expense 80000 020 16000 MACRS depreciat...View the full answer

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Pavlovich Instruments, Inc., a maker of precision telescopes, expects to report pre-tax income of $430,000 this year. The company's financial manager is considering the timing of a purchase of new...

-

Pavlovich Instruments, Inc., a maker of precision telescopes, expects to report pre-tax income of $430,000 this year. The company's financial manager is considering the timing of a purchase of new...

-

Maxmarine plc builds boats. Earlier this year the company accepted an order for 15 specialized Crest boats at a fixed price of 100 000 each. The contract allows four months for building and delivery...

-

NIU Company's budgeted sales and direct materials purchases are as follows: NIU's sales are 40% cash and 60% credit. It collects credit sales 10% in the month of sale, 50% in the month following...

-

Find the area of the region between the curve x = e2t, y = e-t, and x-axis from t = 0 to t = ln 5. Make a sketch.

-

A particle moving along a straight line is subjected to a deceleration a = (-2v) m/s, where v is in m/s. If it has a velocity v = 8 m/s and a position s = 10m when t = 0, determine its velocity and...

-

Where do we get the amounts to enter in the Unadjusted Thai Balance columns of a work sheet?

-

Thorpe Company produces wireless phones. One model is the miniphone'a basic model that is very small and slim. The miniphone fits into a shirt pocket. Another model, the netphone, has a larger...

-

If real U.S. interest rate is higher than real European interest rate, the demand for U.S. Dollar would likely ____, and the supply of Euros to be exchanged for dollars would likely ____, other...

-

For the coming year, Bernardino Company anticipates a unit selling price of $85, a unit variable cost of $15, and fixed costs of $420,000. Instruction 1. Compute the anticipated break-even sales...

-

In early 2019, Sosa Enterprises purchased a new machine for $10,000 to make cork stoppers for wine bottles. The machine has a 3-year recovery period and is expected to have a salvage value of $2,000....

-

Consider the following balance sheets and selected data from the income statement of Keith Corporation. a. Calculate the firms net operating profit after taxes (NOPAT) for the year ended December 31,...

-

Using value-chain costing to measure customer profitability Refer to the data about the Monroe Paper Company presented in Exercise 17-4. Additional information is presented below. Big City Newspaper...

-

reflective account of your development as a postgraduate learner since joining SBS considering the points below. Critically reflect on one or more points below: Assessment Criteria Use a reflective...

-

Technology, strategy, size, and environment are among the factors that influence leaders' choice of organization structure (Schulman, 2020). The leaders must consider the technology to be used in the...

-

6. Answer the following briefly. a.What is the metric and its hurdle rate for an "Enterprise" to increase its enterprise value? b.What is the metric and its hurdle rate for the corporation's equity...

-

Name the two major preceding management theories that contributed to the development of quality management theory. Briefly explain the major concepts of each of these preceding theories that were...

-

922-19x 8 After finding the partial fraction decomposition. (22 + 4)(x-4) dx = dz Notice you are NOT antidifferentiating...just give the decomposition. x+6 Integrate -dx. x33x The partial fraction...

-

A homeowner is trying to decide between a high-efficiency natural gas furnace with an efficiency of 97 percent and a ground-source heat pump with a COP of 3.5. The unit costs of electricity and...

-

"Standard-cost procedures are particularly applicable to process-costing situations." Do you agree? Why?

-

Book and liquidation value The balance sheet for Gallinas Industries is as follows. Additional information with respect to the firm is available: (1) Preferred stock can be liquidated at book value....

-

Giant Enterprises stock has a required return of 14.8%. The company, which plans to pay a dividend of $2.60 per share in the coming year, anticipates that its future dividends will increase at an...

-

Do some reading in periodicals and/or on the Internet to find out more about the Sarbanes-Oxley Acts provisions for companies. Select one of those provisions, and indicate why you think financial...

-

What is the Breakeven Point in units assuming a product selling price is $100, Fixed Costs are $8,000, Variable Costs are $20, and Operating Income is $32,000 ? 100 units 300 units 400 units 500 units

-

Given the following financial data for the Smith Corporation, calculate the length of the firm's operating cycle (OC). Sales $2,610,000 Cost of Good Sold $2,088,000 Inventory $ 278,400 Accounts...

-

The predetermined overhead rate is usually calculated Group of answer choices At the end of each year At the beginning of each month At the beginning of the year At the end of the month

Study smarter with the SolutionInn App