Picture Perfect Solutions reported a tax loss carryforward of $995,000. Two companies are interested in acquiring Picture

Question:

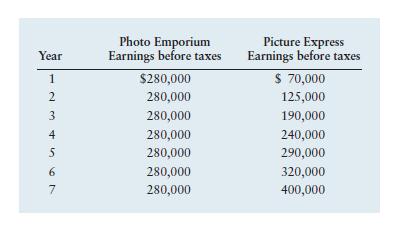

Picture Perfect Solutions reported a tax loss carryforward of $995,000. Two companies are interested in acquiring Picture Perfect Solutions for the amount of the tax loss. Photo Emporium has a cost of capital of 12%, and Picture Express has a cost of capital of 14%. The estimates of the earnings before taxes for both firms are presented in the table below. All estimated earnings fall within the annual limit legally allowed for application of the tax loss carryforward resulting from the proposed merger (see footnote 2 on page 773). Both firms have a tax rate of 40%.

a. Calculate the tax advantage of the acquisition each year for Photo Emporium.

b. Calculate the tax advantage of the acquisition each year for Picture Express.

c. Calculate the maximum cash price each firm would be willing to pay to acquire Picture Perfect Solutions.

d. Which acquisition offer should Picture Perfect Solutions accept? Explain.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter