Revisit Example 13.4 for Lo Road and Hi Road companies. The required returns on equity and debt

Question:

Revisit Example 13.4 for Lo Road and Hi Road companies. The required returns on equity and debt are higher for Hi than for Lo. How can the cost of capital for both firms be 12%?

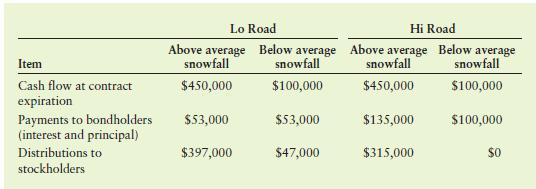

Data from Example 13.4

Sunnybrook, New York has awarded one-year road maintenance contracts to two companies—Lo Road and Hi Road. The value of these contracts depends on the amount of snowfall during the upcoming winter. If snowfall is above average, each company will earn a fee, net of maintenance costs, of $450,000, and if snowfall is below average, each will net $100,000. It is equally likely that the snowfall in Sunnybrook will be above or below average.

To finance the costs of maintaining Sunnybrook’s roads, both companies issued short-term bonds that mature in one year, but Hi Road borrowed more money (and used more leverage) than Lo Road. Lo must pay $53,000 in principal and interest in one year and Hi must pay $135,000. If the winter snowfall is below average, Hi will declare bankruptcy because it will not be able to pay its bond obligation in full. If this happens, Hi’s stockholders will lose their investment and its bondholders will receive the $100,000 management fee.

Hi’s bondholders are promised a 10% return and its stockholders require a 13.5415% rate of return. Lo’s bondholders and stockholders are both willing to accept slightly lower returns because Lo uses less financial leverage. Lo’s bondholders receive an 8% return and its stockholders have a required return of 13%.

With the simplifying assumption that neither company pays taxes, the following table details the payoffs to stockholders and bondholders for both firms.

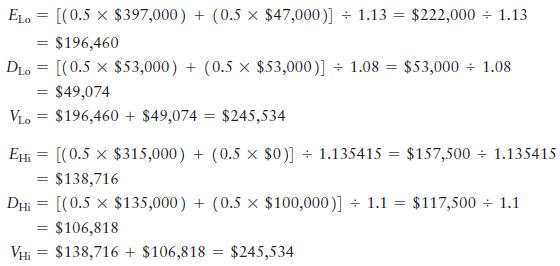

The equity, E, and debt, D, values for Lo and Hi, equal the present value of the expected payoffs to each investor group found using the required returns to discount cash flows. The firm value, V, is equal to the sum of values for equity and debt: V = E + D. Remember that there is an equal (50%) probability of above- and below-average snowfall.

We see that higher financial leverage means that Hi’s bondholders and stockholders bear more risk. However, if Hi goes bankrupt, ownership transfers at no cost from stockholders to bondholders. As a result, both Hi and Lo are worth $245,534, and the fact that one firm borrows more than the other is irrelevant when bankruptcy is costless. It is also worth noting that the weighted average cost of capital for maintaining roads is 12% for both firms. Given the M&M propositions, it is not surprising that Hi’s WACC is the same as Lo’s.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart