The chapter opener describes a shift in Lowes financial strategy that began in April 2012. Specifically, Lowes

Question:

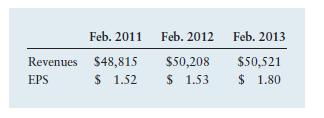

The chapter opener describes a shift in Lowe’s financial strategy that began in April 2012. Specifically, Lowe’s took actions that increased its reliance on debt. The following table shows Lowe’s annual revenues (in millions) and its earnings per share (EPS) for the fiscal years ending in February 2011, 2012, and 2013. Use these figures to answer the questions.

a. Now that the company has decided to use the proceeds from a bond issue to repurchase shares, what would you expect the effect of that decision to be on Lowe’s degree of total leverage?

b. Calculate the percentage change in revenues and in EPS from 2011 to 2012 (before Lowe’s altered its capital structure). What was Lowe’s degree of total leverage at this time?

c. Calculate the percentage changes in revenues and EPS from 2012 to 2013 (after Lowe’s altered its capital structure). What was Lowe’s degree of total leverage at this time?

d. Do your findings in questions b and c align with your expectations from question a?

e. What do you think happened to the beta of Lowe’s common stock from 2011 to 2013?

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter