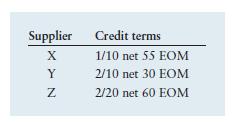

The credit terms for each of three suppliers are shown in the following table. Assume a 365-day

Question:

The credit terms for each of three suppliers are shown in the following table. Assume a 365-day year.

a. Determine the approximate cost of giving up the cash discount from each supplier.

b. Assuming that the firm needs short-term financing, indicate whether it would be better to give up the cash discount or take the discount and borrow from a bank at 15% annual interest. Evaluate each supplier separately using your findings in part a.

c. Now assume that the firm could stretch its accounts payable (net period only) by 20 days from supplier Z. What impact, if any, would that have on your answer in part b relative to this supplier?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted: