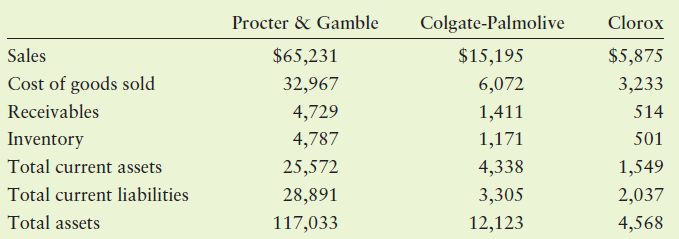

The table below shows key financial data for three firms that compete in the consumer products market:

Question:

The table below shows key financial data for three firms that compete in the consumer products market: Procter & Gamble, Colgate-Palmolive, and Clorox. All dollar values are in thousands.

a. Calculate each of the following ratios for all three companies: current ratio, quick ratio, inventory turnover, average collection period, total asset turnover.

b. Which company is in the position of having greatest liquidity?

c. Would you say that the three companies exhibit similar performance or quite different

performance in terms of collecting receivables? Why do you think that might be?

d. Which company has the most rapid inventory turnover? Which company appears to be least efficient in terms of total asset turnover? Are your answers to those questions a little surprising? If a company is best at inventory turnover and worst at total asset turnover, what do you think that means?

Step by Step Answer:

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart