Springfield Bank is evaluating Creek Enterprises, which has requested a $4,000,000 loan, to assess the firms financial

Question:

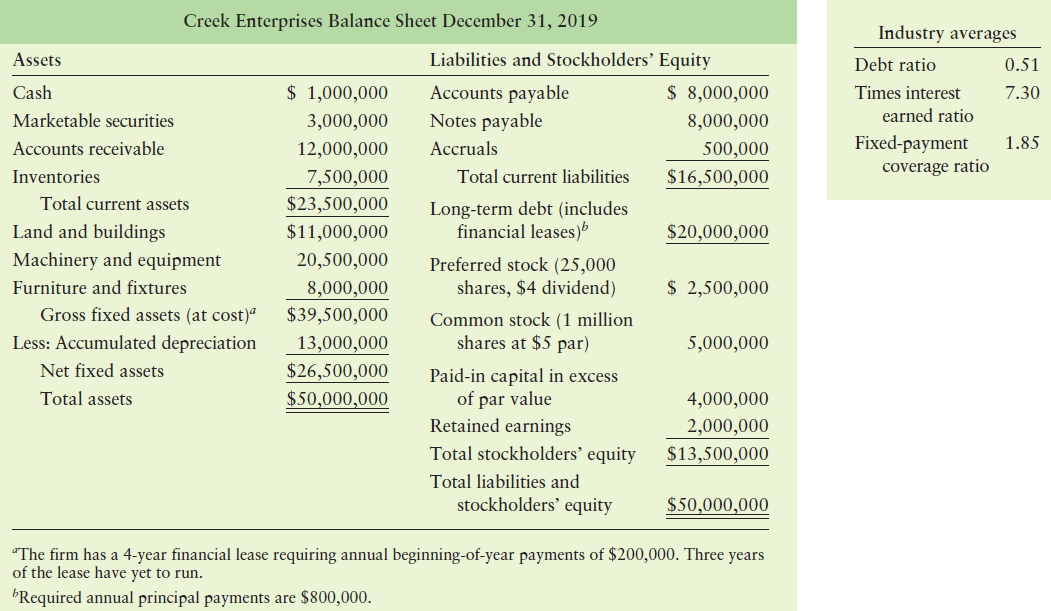

Springfield Bank is evaluating Creek Enterprises, which has requested a $4,000,000 loan, to assess the firm’s financial leverage and financial risk. On the basis of the debt ratios for Creek, along with the industry average and Creek’s recent financial statements (following), evaluate and recommend appropriate action on the loan request.

Creek Enterprises Income Statement

for the Year Ended December 31, 2019

Sales revenue .................................................................$30,000,000

Less: Cost of goods sold .................................................21,000,000

Gross profits ...................................................................$ 9,000,000

Less: Operating expenses

Selling expense ..............................................................$ 3,000,000

General and administrative expenses ...........................1,800,000

Lease expense .....................................................................200,000

Depreciation expense .....................................................1,000,000

Total operating expense ..............................................$ 6,000,000

Operating profits...........................................................$ 3,000,000

Less: Interest expense ....................................................1,000,000

Net profits before taxes ..............................................$ 2,000,000

Less: Taxes (rate = 40%) ....................................................800,000

Net profits after taxes .................................................$ 1,200,000

Less: Preferred stock dividends ....................................100,0000

Earnings available for common stockholders .........$ 1,100,000

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart