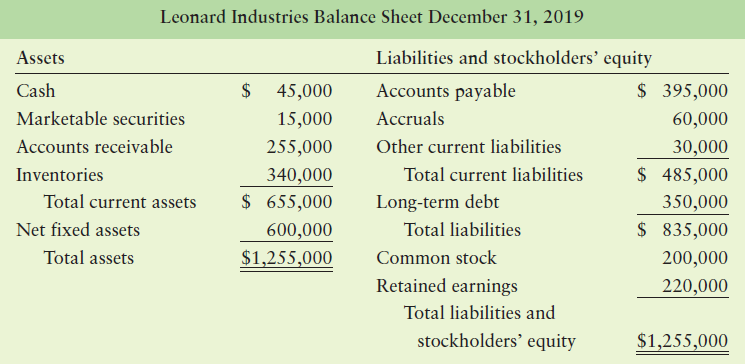

Leonard Industries wishes to prepare a pro forma balance sheet for December 31, 2020. The firm expects

Question:

Leonard Industries wishes to prepare a pro forma balance sheet for December 31, 2020. The firm expects 2020 sales to total $3,000,000. The following information has been gathered:

(1) A minimum cash balance of $50,000 is desired.

(2) Marketable securities are expected to remain unchanged.

(3) Accounts receivable represent 10% of sales.

(4) Inventories represent 12% of sales.

(5) A new machine costing $90,000 will be acquired during 2020. Total depreciation

for the year will be $32,000.

(6) Accounts payable represent 14% of sales.

(7) Accruals, other current liabilities, long-term debt, and common stock are expected to remain unchanged.

(8) The firm’s net profit margin is 4%, and it expects to pay out $70,000 in cash dividends during 2020.

(9) The December 31, 2019, balance sheet follows.

a. Use the judgmental approach to prepare a pro forma balance sheet dated December 31, 2020, for Leonard Industries.

b. How much, if any, additional financing will Leonard Industries require in 2020? Discuss.

c. Could Leonard Industries adjust its planned 2020 dividend to avoid the situation described in part b? Explain how.

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart