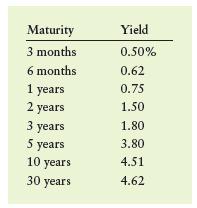

The yields for Treasuries with differing maturities on a recent day are shown in the following table.

Question:

The yields for Treasuries with differing maturities on a recent day are shown in the following table.

a. Use this information to plot a yield curve for this date.

b. If the expectations hypothesis is true, approximately what rate of return do investors expect a five-year Treasury note to pay five years from now?

c. If the expectations hypothesis is true, approximately what rate of return do investors expect a one-year Treasury security to pay starting two years from now?

d. Is it possible that even though the yield curve slopes up in this problem, investors will not be expecting rising interest rates? Explain.

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart

Question Posted: