Using the free cash flow valuation model to price an IPO Assume that you have an opportunity

Question:

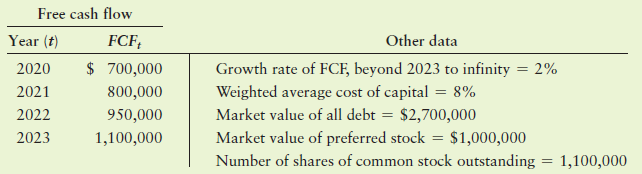

Using the free cash flow valuation model to price an IPO Assume that you have an opportunity to buy the stock of CoolTech Inc., an IPO being offered for $12.50 per share. Although you are very much interested in owning the company, you are concerned about whether it is fairly priced. To determine the value of the shares, you have decided to apply the free cash flow valuation model to the firm’s financial data that you’ve accumulated from a variety of data sources. The key values you have compiled are summarized in the following table.

a. Use the free cash flow valuation model to estimate CoolTech’s common stock value per share.

b. Judging by your finding in part a and the stock’s offering price, should you buy the stock?

c. On further analysis, you find that the growth rate of FCF beyond 2023 will be 3% rather than 2%. What effect would this finding have on your responses in parts a and b?

Free cash flow Year (t) Other data FCF; Growth rate of FCF, beyond 2023 to infinity Weighted average cost of capital = 8% Market value of all debt = $2,700,000 Market value of preferred stock = $1,000,000 Number of shares of common stock outstanding $ 700,000 2020 2% 2021 2022 2023 800,000 950,000 1,100,000 1,100,000

Step by Step Answer:

a The value of the firms common stock may be found in four steps Step 1 Find present value in 2023 o...View the full answer

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart

Related Video

The weighted average cost of capital (WACC) represents a firm\'s average after-tax cost of capital from all sources, including common stock, preferred stock, bonds, and other forms of debt. WACC is the average rate that a company expects to pay to finance its assets

Students also viewed these Business questions

-

Your portfolio has three asset classes. U.S. government T-bills account for 45% of the portfolio, large-company stocks constitute another 40%, and small-company stocks make up the remaining 15%. If...

-

Taylor Systems has just issued preferred stock. The stock has an 8% annual dividend and a $100 par value and was sold at $99.50 per share. In addition, flotation costs of $1.50 per share must be...

-

A simple trust has the following receipts and expenditures for 2018. The trust instrument is silent with respect to capital gains, and state law concerning trust accounting income follows the Uniform...

-

On the income statement for the year ending December 31, Y1, the accountant for ABC calculated operating income before taxes of $300,000. This $300,000 did not include the effect of any of the...

-

Find the area of the ellipse b2x2 + a2y2 = a2b2.

-

In Exercises find the limit (if it exists). If it does not exist, explain why. lim r-0 1 x + 4x 1 X

-

analyze and discuss the evolution of quality in healthcare;

-

Since 1938, when auditors failed to uncover fictitious inventory recorded by the McKesson & Robbins Company, auditors have been ordinarily required to physically observe the counting of inventory. It...

-

Question 3 Part 1 Hammer Company is a well-established manufacturer of equipment used in the catering industry employing perpetual inventory system. Hammer's products range from small to large...

-

When resulting in mostly intangible benefits, how would you rank a projects priority level against other projects with quantifiable outcomes? How can technical innovations or other innovations drive...

-

Constant growth Over the past 6 years, Elk County Telephone has paid the dividends shown in the following table. Year Dividend per share 2019....................................... $2.87...

-

Mike is searching for a stock to include in his current stock portfolio. He is interested in Hi-Tech Inc.; he has been impressed with the companys computer products and believes that Hi-Tech is an...

-

A small object with electric dipole moment p is placed in a non-uniform electric field E = E(x)i. That is, the field is in the x direction and its magnitude depends on the coordinate x. Let represent...

-

1) Factor the following Expressions (Write your factors only, don't show your work) a) 2x - 32 = c) 3x-2x-8= b) 2x-6x-8=

-

Bloomfield Inc. manufactures widgets. A major piece of equipment used to make the widget is nearing the end of its useful life. The company is trying to decide whether they should lease new equipment...

-

1. a. What is network management? Illustrate network management functional flowchart. [2.5] b. What encoding and decoding mechanisms are used in fast Ethernet and gigabit Ethernet? What is meant by...

-

Project Data: Sam Parker owns and operates a consulting firm called Business Solutions. The business began operating in October 202X. Transactions for October and November 202X have been recorded and...

-

3. Use Hooke's law to predict which one out of each pair vibrates at a higher wavenumber. Explain your answer. (7 points) a) C-H and C-D* b) C-C and C=C where: 1 k v = 2, v=wavenumber c = velocity of...

-

For the following exercises, find an equation for the graph of each function. X = - x= f(x) 10- -6 |-10- 2 Y 2 X = x

-

Gopher, Inc. developing its upcoming budgeted Costs of Quality (COQ) with the following information: Expense Item Budget Raw Materials Inspection $ 15,000 EPA Fine 200,000 Design Engineering 15,000...

-

A 2-year Treasury bond currently offers a 6% rate of return. A 3-year Treasury bond offers a 7% rate of return. Under the expectations theory, what rate of return do investors expect a 2-year...

-

Economic forecasters predict that the rate of inflation in Singapore will be at 3% over the next few decades. The following table shows the nominal interest paid on Treasury securities having...

-

Jack Trading and Brokerage Ltd. wishes to evaluate interest rate behavior. They have gathered data from five Treasury securities issued by Deutsche Bundesbank, Germanys central bank. Each security...

-

Sweeten Company had no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments --Molding and Fabrication. It started, completed, and...

-

Horizontal Analysis The comparative accounts payable and long-term debt balances of a company are provided below. Current Year Previous Year Accounts payable $47,286 $63,900 Long-term debt 85,492...

-

On January 1, Year 1, Price Company issued $140,000 of five-year, 7 percent bonds at 97. Interest is payable annually on December 31. The discount is amortized using the straight-line method. Record...

Study smarter with the SolutionInn App