Woodpecker Manufacturing replaces its equipment and machinery on a regular basis. A number of pieces of equipment

Question:

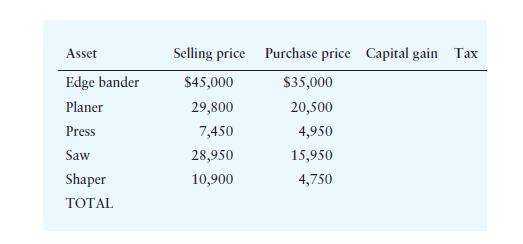

Woodpecker Manufacturing replaces its equipment and machinery on a regular basis. A number of pieces of equipment and machinery will be sold during the next month. Assume a 40% tax rate, and complete the following table. How much total capital gains tax will Woodpecker Manufacturing pay?

Transcribed Image Text:

Asset Edge bander Planer Press Saw Shaper TOTAL Selling price $45,000 29,800 7,450 28,950 10,900 Purchase price Capital gain Tax $35,000 20,500 4,950 15,950 4,750

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

To calculate the total capital gains tax that Woodpecker Manufacturing will pay we first need to cal...View the full answer

Answered By

User l_1034280

Throughout my academic journey and hands-on projects, I have accumulated a diverse range of experiences that have honed my skills as a coding, database, and Unix applications specialist. I have delved into complex coding challenges, crafting software solutions that merge functionality with efficiency. My database management expertise has been put to the test, designing and optimizing data systems that drive business intelligence and decision-making. In the realm of Unix applications, I've confidently navigated the intricate landscape of Unix-based systems, scripting automation, and ensuring robust system administration. These experiences have not only solidified my technical prowess but have also instilled in me a profound appreciation for the limitless possibilities that technology offers in solving real-world problems.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted:

Students also viewed these Business questions

-

A bakery with a December 31 st year end purchased new equipment on October 31 st 2000 for $10,000. This was their first equipment purchase. Required: What are the tax consequences if the equipment is...

-

Ann Carter, Chief Financial Officer of Consolidated Electric Company (Con El), must make a recommendation to Con Els board of directors regarding the firms dividend policy. Con El owns two...

-

The balance sheets of Forest Company and Garden Company are presented below as at December 31, Year 8. Additional Information ¢ Forest acquired 90% of Garden for $207,900 on July 1, Year 1, and...

-

The insurance company Helmet is considering acquiring BeSafe, a life insurance company. According to BeSafes most recent financial statements, its loss ratio stands at 0.9, and its expense ratio...

-

A small postage stamp is placed in front of a concave mirror (radius = R) so that the image distance equals the object distance. (a) In terms of R, what is the object distance? (b) What is the...

-

Is assigning costs accurately as important for services as it is for tangible products? lop52

-

16. Suppose that the exchange rate is $0.92/=C. Let r$ = 4%, and r=C = 3%, u = 1.2, d = 0.9, T = 0.75, n = 3, and K = $0.85. a. What is the price of a 9-month European call? b. What is the price of a...

-

Advertising is an expenditure that ultimately must be justified in terms of its effect on sales and profits, yet most evaluations of advertising are in terms of the effects on attitudes. How do you...

-

please show work Blossom Bucket Co., a manufacturer of rain barrels, had the following data for 2021: W Sales quantity 2,430 barrels Unit selling price $40 per barrel Unit variable costs $20 per...

-

One criticism of Hofstedes work is that the scores on each dimension reflect only an average tendency of a particular country and, therefore, inadequately reflect the wide range of responses given...

-

Hamberg Manufacturing identified two vehicles from the vehicle pool that can be sold. The purchase prices were $2,500 and $3,000 for Vehicle 1 and Vehicle 2, respectively, and the expected selling...

-

Porter Corporation forecast that it would generate earnings before interest and tax of $250,000 for the current financial year. Assume a flat tax rate of 35% and all after-tax earnings are paid to...

-

Another possible external-memorymap implementation is to use a skip list, but to collect consecutive groups of O(B) nodes, in individual blocks, on any level in the skip list. In particular, we...

-

3. The Balance Sheet of International Operators Ltd. as at 31.03.2021 disclose the following position: PARTICULARS SHARE CAPITAL RESERVES AND SURPLUS SECURED LOANS UNSECURED LOANS CURRENT LIABILITY...

-

A uniformly charged ring of radius a. (a) The field at P on the x axis due to an element of charge dq. (b) The perpendicular component of the field at P due to segment 1 is canceled by the...

-

At what rate would $1,000 have to be invested to grow to $4,046 in 10 years?

-

Add F1 and F2 using graphical method, (triangle or parallelogram) Determine: 1 Magnitude,2. Direction measured CCW from positive axis, im now to America need help. CoursHeroTranscribedText 20 F-SON...

-

What is Monetary Policy? What is Monetary Base or High Powered Money? How commercial Banks create money Supply? Hint: By giving loans through creating checking account What is deposit multiplier?...

-

Sabre Corporation, which reports under IFRS, has the following investments at December 31, 2018: 1. Held for trading investments: common shares of National Bank, cost $38,000, fair value $45,000. 2....

-

Evaluate the integral, if it exists. Jo y(y + 1) dy

-

How is the percent-of-sales method used to prepare pro forma income statements?

-

Why does the presence of fixed costs cause the percent-of-sales method of pro forma income statement preparation to fail? What is a better method?

-

Describe the judgmental approach for simplified preparation of the pro forma balance sheet.

-

Hite corporation intends to issue $160,000 of 5% convertible bonds with a conversion price of $40 per share. The company has 40,000 shares of common stock outstanding and expects to earn $600,000...

-

Your portfolio has a beta of 1.17, a standard deviation of 14.3 percent, and an expected return of 12.5 percent. The market return is 11.3 percent and the risk-free rate is 3.1 percent. What is the...

-

Slow Roll Drum Co. is evaluating the extension of credit to a new group of customers. Although these customers will provide $198,000 in additional credit sales, 13 percent are likely to be...

Study smarter with the SolutionInn App