Company Elmira reported the following cost of goods sold but later realized that an error had been

Question:

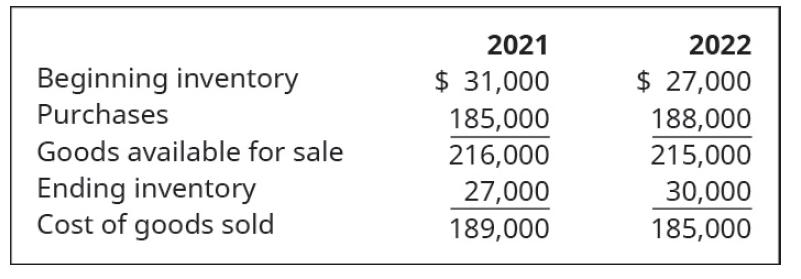

Company Elmira reported the following cost of goods sold but later realized that an error had been made in ending inventory for year 2021. The correct inventory amount for 2021 was 32,000. Once the error is corrected, (a) how much is the restated cost of goods sold for 2021? and (b) how much is the restated cost of goods sold for 2022?

Transcribed Image Text:

Beginning inventory Purchases Goods available for sale Ending inventory Cost of goods sold 2021 $ 31,000 185,000 216,000 27,000 189,000 2022 $ 27,000 188,000 215,000 30,000 185,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (10 reviews)

a The restated cost of go...View the full answer

Answered By

Brian Otieno

I'm Brian , an experienced professional freelancer with countless hours of success in freelancing many subjects in different disciplines. Specifically, I have handled many subjects and excelled in many disciplines. I have worked on many Computer Science projects and have been able to achieve a lot in that field. Additionally, I have handled other disciplines like History, Humanities, Social Sciences, Political science, Health care and life science, and Religion / Theology. My experience generally in these subjects has made me able to deliver high-quality projects in a very timely fashion. I am very reliable at my job and will get the work done in time, no matter what. In Addition, I have managed to ensure that the work meets my client's expectations and does not cause an error. I am a hard-working and diligent person who is highly responsible for everything I do. Generally, Freelancing has made me more accountable for doing my job. Additionally, I have had a passion for writing for the last seven years in this field.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Students also viewed these Business questions

-

On January 1, 2020 Plumbus Inc. is issued a notes payable for $32,000. The note has an interest rate of 6% and will be paid semi-annually over two years. The payment terms are a blended payment of...

-

Company Edgar reported the following cost of goods sold but later realized that an error had been made in ending inventory for year 2021. The correct inventory amount for 2021 was 12,000. Once the...

-

For each situation given, calculate cost of goods sold and identify if the information provided reflects a perpetual or periodic inventory system. a. b. A physical inventory count at year-end showed...

-

Holt Company purchased a computer for $8,000 on January 1, 2009. Straight-line depreciation is used, based on a 5-year life and a $1,000 salvage value . In 2011, the estimates are revised. Holt now...

-

Refer to Problem 3. Barton decides to buy a full-sized grand piano. The new payoff matrix is as follows: a. If Statler has the legal right to peace and quiet and Barton and Statler can negotiate at...

-

In most organizations, managers address many HR-re... Bookmark In most organizations, managers address many HR-related issues on a daily basis. While it is prudent to seek advice from HR...

-

Federal civil trial appeals. The Journal of the American Law and Economics Association (Vol. 3, 2001) published the results of a study of appeals of federal civil trials. The accompanying table,...

-

1. Based on concepts discussed in this chapter, describe the factors that have contributed to 3M's new product success. 2. Is 3M's product development process customer centered? Why or why not? 3....

-

star co. had pretax net income of $32,000, MACRS depreciation of $4,000, book depreciation of $6,000, and accrued warranty expense of $3,000 on the books and actual warranty costs of $7,000. How much...

-

FAME (Forondo Artist Management Excellence) Inc. is an artist management company that represents classical music artists (only soloists) both nationally and internationally. FAME has more than 500...

-

What type of issues would arise that might cause inventory errors?

-

Which of the following would cause periodic ending inventory to be overstated? A. Goods held on consignment are omitted from the physical count. B. Goods purchased and delivered, but not yet paid...

-

The graphs below show the weights of professional basketball players. One graph displays the weights of Centers (C) and the other graph displays the weights of Shooting Guards (SG). Write one or two...

-

Solve these question in details and fully explaination. It is the pre-lab working for Capacitors. Thanks so much in advance. 1: The figure shows a circuit with a charged capacitor (left), two...

-

Exercise 10-14A (Algo) Straight-line amortization of a bond discount LO 10-4 Diaz Company issued bonds with a $112,000 face value on January 1, Year 1. The bonds had a 8 percent stated rate of...

-

1. What would we have to plot on the vertical axis? EXPLAIN YOUR ANSWER OR NO CREDIT. [Hint: Solve for k first.] F= Kx kx dala you Experi determine the K= K = F Cart SHOW ALL WORK OR NO CREDITI 2....

-

You are interested in computing the heat transfer properties of a new insulation system shown here. Tair Air Layer 1 Layer 2 T P

-

16.3 The demand function for replicas for the Statue of Liberty is given by f(p): = 500 - 2p, where f(p) is the number of statues that can be sold for p dollars. (a) What is the relative rate of...

-

Use U universal set = {0, 1, 2, 3, 4, 5, 6, 7, 8, 9}, A = {1, 3, 4, 5, 9}, and C = {1,3,4,6} to find the set. BUC

-

You've been asked to take over leadership of a group of paralegals that once had a reputation for being a tight-knit, supportive team, but you quickly figure out that this team is in danger of...

-

Harry and Mary Prodigious are married filing jointly and have 12 dependent children. Six of the children are under age 17. With the large number of children, they live in a very austere manner....

-

Allen, an unmarried taxpayer filing single, has no dependents and reports the following items on his 2017 federal income tax return: Adjusted gross income $82,450 Taxable income ........47,950...

-

Amelia has wages of $45,000 and net income from a small unincorporated business of $70,000 for 2017. a. What is the amount of Amelias self-employment (SE) tax and deduction for AGI for her SE tax? b....

-

ABC Insurance Company reported the following information on its accounting statements last year: What was ABC 's expense ratio last year

-

Calculate the current ratio and the quick ratio for the following partial financial statement for Tootsie Roll Note: Round your answers to the nearest hundredth

-

Required information Skip to question [ The following information applies to the questions displayed below. ] Golden Corporation's current year income statement, comparative balance sheets, and...

Study smarter with the SolutionInn App