Prepare journal entries to record the following transactions, assuming periodic inventory updating and first-in, first-out (FIFO) cost

Question:

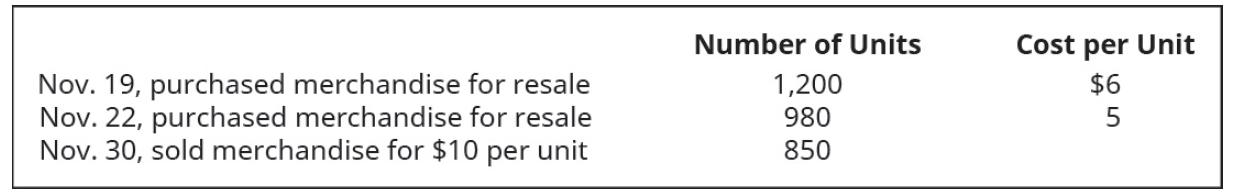

Prepare journal entries to record the following transactions, assuming periodic inventory updating and first-in, first-out (FIFO) cost allocation.

Transcribed Image Text:

Nov. 19, purchased merchandise for resale Nov. 22, purchased merchandise for resale Nov. 30, sold merchandise for $10 per unit Number of Units 1,200 980 850 Cost per Unit $6 5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 53% (13 reviews)

Journal Entries for FIFO On November 19th to record the purchase of merchandise Debit Merchan...View the full answer

Answered By

Labindao Antoque

I graduated in 2018 with a Bachelor of Science degree in Psychology from Dalubhasaan ng Lungsod ng San Pablo. I tutored students in classes and out of classes. I use a variety of strategies to tutor students that include: lecture, discussions about the subject matter, problem solving examples using the principles of the subject matter being discussed in class , homework assignments that are directed towards reinforcing what we learn in class , and detailed practice problems help students to master a concept. I also do thorough research on Internet resources or textbooks so that I know what students need to learn in order to master what is being taught in class .

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Prepare journal entries to record the following transactions for a retail store. Assume a perpetual inventory system. Apr. 2 Purchased merchandise from Blue Company under the following terms: $3,600...

-

Prepare journal entries to record the following transactions of a non-government not-for-profit organization. 1. Received pledges of $1,000,000; 15% are expected to be uncollectible. No collections...

-

Prepare journal entries to record the following transactions for a retail store. Assume a perpetual inventory system. Apr. 2 Purchased merchandise from Johns Company under the following terms: $5,900...

-

1. If an industry is formed by six companies. Four companies have sales of $ 10 each, and two companies have sales of $ 5 each. a. What is the concentration ratio of four companies for this industry?...

-

For each of the following transactions, state the effect both on U.S. GDP and on the four components of aggregate expenditure. (L02) a. Your mother buys a new car from a U.S. producer. b. Your mother...

-

ERP systems provide a wealth of information that can be used and analyzed in a wide variety of ways. What is an inherent risk with so much information?

-

93.19

-

In August 2017, voters of Balcones, a medium-sized city, approved a $15 million general obligation bond issue to finance the construction of recreational facilities. In order to begin construction...

-

The general ledger of the Karlin Company, a consulting company, at January 1, 2021, contained the following account balances: Account Title Debits Credits Cash 33,200 Accounts receivable 10,500...

-

Dominos Pizza franchises in New York were sued by the state of New York for wage theft at 10 stores. Under New York law, a corporation and a franchiser are joint employers if they meet certain...

-

Search the SEC website (https://www.sec.gov/edgar/searchedgar/companysearch.html) and locate the latest Form 10-K for a company you would like to analyze. Submit a short memo that states the...

-

Use the weighted-average (AVG) cost allocation method, with perpetual inventory updating, to calculate (a) Sales revenue, (b) Cost of goods sold, and (c) Gross margin for B75 Company, considering the...

-

During the course of your examination of the financial statements of Trojan Corporation for the year ended December 31, 2012, you come across several items needing further consideration. Currently,...

-

A parent acquires all of the stock of a subsidiary for $40 million in cash. The subsidiarys books report the following account balances at the date of acquisition (in trial balance format)....

-

1. Given: The sign for the Inn of the Prancing Pony in Bree-yes, it comes in pints-is fixed on the end of a beam of length 5L. If the sigh deflects too much then Gandalf will hit his head when he...

-

Q21) Add positive and negative charges as shown in the diagram below. Use the arrows of the simulation to guide you in drawing continuous electric field lines around and in between the three charges....

-

When 10.1 g CaO is dropped into a styrofoam coffee cup containing 157 g H2O at 18.0C, the temperature rises to 35.8C. Calculate the enthalpy change of the following reaction in kJ/mol CaO. Assume...

-

4-12. Sometimes heterogeneous chemical reactions take place at the walls of tubes in which reactive mixtures are flowing. If species A is being consumed at a tube wall because of a chemical reaction,...

-

Simplify the expression. -4 2

-

One study found that the elderly who do not have children dissave at about the same rate as the elderly who do have children. What might this finding imply about the reason the elderly do not dissave...

-

What is the definition of medical care for purposes of the medical care deduction?

-

a. What is the definition of cosmetic surgery under the Internal Revenue Code? b. Is the cost of cosmetic surgery deductible as a medical expense? Explain.

-

Virginia is a cash-basis, calendar-year taxpayer. Her salary is $20,000, and she is single. She plans to purchase a residence in 2017. She anticipates her property taxes and interest will total...

-

Accounting changes fall into one of three categories. Identify and explain these categories and give an example of each one.

-

Machinery is purchased on May 15, 2015 for $120,000 with a $10,000 salvage value and a five year life. The half year convention is followed. What method of depreciation will give the highest amount...

-

Flint Corporation was organized on January 1, 2020. It is authorized to issue 14,000 shares of 8%, $100 par value preferred stock, and 514,000 shares of no-par common stock with a stated value of $2...

Study smarter with the SolutionInn App