Prepare journal entries to record the following transactions, assuming perpetual inventory updating and last-in, first-out (LIFO) cost

Question:

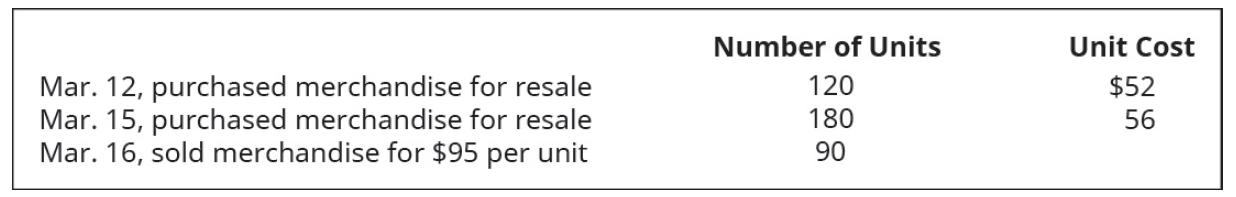

Prepare journal entries to record the following transactions, assuming perpetual inventory updating and last-in, first-out (LIFO) cost allocation. Assume no beginning inventory.

Transcribed Image Text:

Mar. 12, purchased merchandise for resale Mar. 15, purchased merchandise for resale Mar. 16, sold merchandise for $95 per unit Number of Units 120 180 90 Unit Cost $52 56

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (6 reviews)

Mar 12 purchased merchandise for resale 120 units at 52uni...View the full answer

Answered By

Labindao Antoque

I graduated in 2018 with a Bachelor of Science degree in Psychology from Dalubhasaan ng Lungsod ng San Pablo. I tutored students in classes and out of classes. I use a variety of strategies to tutor students that include: lecture, discussions about the subject matter, problem solving examples using the principles of the subject matter being discussed in class , homework assignments that are directed towards reinforcing what we learn in class , and detailed practice problems help students to master a concept. I also do thorough research on Internet resources or textbooks so that I know what students need to learn in order to master what is being taught in class .

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Prepare journal entries to record the following transactions for a retail store. Assume a perpetual inventory system. Apr. 2 Purchased merchandise from Blue Company under the following terms: $3,600...

-

Prepare journal entries to record the following transactions for a retail store. Assume a perpetual inventory system. Apr. 2 Purchased merchandise from Lyon Company under the following terms: $4,600...

-

Prepare journal entries to record the following transactions for a retail store. Assume a perpetual inventory system. Apr. 2 Purchased merchandise from Johns Company under the following terms: $5,900...

-

Arginine, the most basic of the 20 common amino acids, contains a guanidino functional group in its side chain. Explain, using resonance structures to show how the protonated guanidino group...

-

If Congress could declare illegal any activity that imposes external costs on others, would such legislation be advisable?

-

Labor costs of an auto repair mechanic are seldom based on actual hours worked. Instead, the amount paid a mechanic is based on an industry average of time estimated to complete a repair job. The...

-

A and B are mutually exclusive events, with P1A2 = .3 and P1B2 = .4. LO5 a. Find P1A0B2. b. Are A and B independent events?

-

Thomas Consultants provided Bran Construction with assistance with implementing various cost-savings initiatives. Thomas' contract specifies that it will receive a flat rate of $50,000 and an...

-

A company has the following sales for the first six months of the year January 1 , 0 1 0 units February 1 , 0 8 7 units March 1 , 1 2 4 units April 1 , 2 1 3 units May 1 , 1 8 5 units June 1 , 1 9 3...

-

Compute the Howells' tax liability for the year (ignoring the alternative minimum tax and any phase-out provisions) assuming they file a joint return, they have no dependents, they don't make any...

-

Which of the following financial statements would be impacted by a current-year ending inventory error, when using a periodic inventory updating system? A. Balance sheet B. Income statement C....

-

Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for B76 Company, considering the following transactions under three different cost allocation methods and using perpetual...

-

Does the sender (maker) of a debit memorandum record a debit or a credit in the recipients account? What entry (debit or credit) does the recipient record? fg4

-

?In civil engineering, what is the main use of a slump test in concrete technology?

-

Briefly explain what spatial autocorrelation means and what method can be used to measure it

-

Discuss the theoretical implications of adopting biodegradable materials in civil engineering for reducing environmental impact and enhancing sustainability.

-

Analyze the role of civil engineering in coastal erosion management. What are the engineering strategies for shoreline protection, beach nourishment, and coastal infrastructure design to mitigate...

-

Analyze the impact of climate change on civil engineering practices, particularly in the areas of coastal and floodplain management, and discuss strategies for mitigating these impacts

-

Use U universal set = {0, 1, 2, 3, 4, 5, 6, 7, 8, 9}, A = {1, 3, 4, 5, 9}, and C = {1,3,4,6} to find the set. A C

-

A sprinkler head malfunctions at midfield in an NFL football field. The puddle of water forms a circular pattern around the sprinkler head with a radius in yards that grows as a function of time, in...

-

In 2017, Ace Corporation reports gross income of $200,000 (including $150,000 of profit from its operations and $50,000 in dividends from less-than-20%-owned domestic corporations) and $220,000 of...

-

Zeta Corporations taxable income for 2016 was $1.5 million, on which Zeta paid federal income taxes of $510,000. Zeta estimates calendar year 2017s taxable income to be $2 million, on which it will...

-

Wright Corporations taxable income for calendar years 2014, 2015, and 2016 was $120,000, $150,000, and $100,000, respectively. Its total tax liability for 2016 was $22,250. Wright estimates that its...

-

Compute the value of ordinary bonds under the following circumstances assuming that the coupon rate is 0.06:(either the correct formula(s) or the correct key strokes must be shown here to receive...

-

A tax-exempt municipal bond has a yield to maturity of 3.92%. An investor, who has a marginal tax rate of 40.00%, would prefer and an otherwise identical taxable corporate bond if it had a yield to...

-

Please note, kindly no handwriting. Q. Suppose a 3 year bond with a 6% coupon rate that was purchased for $760 and had a promised yield of 8%. Suppose that interest rates increased and the price of...

Study smarter with the SolutionInn App