Prepare journal entries to record the following transactions, assuming perpetual inventory updating and first-in, first-out (FIFO) cost

Question:

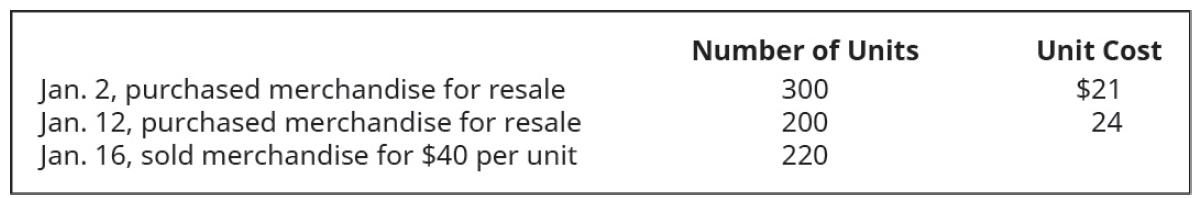

Prepare journal entries to record the following transactions, assuming perpetual inventory updating and first-in, first-out (FIFO) cost allocation. Assume no beginning inventory.

Transcribed Image Text:

Jan. 2, purchased merchandise for resale Jan. 12, purchased merchandise for resale Jan. 16, sold merchandise for $40 per unit Number of Units 300 200 220 Unit Cost $21 24

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 20% (10 reviews)

Jan 2 purchased merchandise for resale 300 units at 2224uni...View the full answer

Answered By

Labindao Antoque

I graduated in 2018 with a Bachelor of Science degree in Psychology from Dalubhasaan ng Lungsod ng San Pablo. I tutored students in classes and out of classes. I use a variety of strategies to tutor students that include: lecture, discussions about the subject matter, problem solving examples using the principles of the subject matter being discussed in class , homework assignments that are directed towards reinforcing what we learn in class , and detailed practice problems help students to master a concept. I also do thorough research on Internet resources or textbooks so that I know what students need to learn in order to master what is being taught in class .

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Prepare journal entries to record the following transactions for a retail store. Assume a perpetual inventory system. Apr. 2 Purchased merchandise from Blue Company under the following terms: $3,600...

-

Prepare journal entries to record the following transactions for a retail store. Assume a perpetual inventory system. Apr. 2 Purchased merchandise from Lyon Company under the following terms: $4,600...

-

Prepare journal entries to record the following transactions for a retail store. Assume a perpetual inventory system. Apr. 2 Purchased merchandise from Johns Company under the following terms: $5,900...

-

Medallion and RIEF (Renaissance Institutional Equity Fund) are both managed by Renaissance Technologies. How do they differ in terms of asset classes, dollar capacity, average holding period of each...

-

Consider the following "dating game," which has two players, A and B, and two strategies, to buy a movie ticket or a baseball ticket. The payoffs, given in points, are as shown in the matrix below....

-

Discuss the types of pension and welfare plans that are exempt from ERISA regulations.

-

Which of the following pairs of events are mutually exclusive? a. A = 5The Tampa Bay Rays win the World Series next year.6 B = 5Evan Longoria, Rays infielder, hits 75 home runs runs next year.6 b. A...

-

Paulis Pizza has recently begun collecting data on the quality of its customer order processing and delivery. Paulis made 1,800 deliveries during the first quarter of 2013. The following quality data...

-

When it comes to financial statements, there is an old saying that states "Financial Statements don't lie, but they also may not tell the full story." In your opinion, what do you think this means?...

-

On February 1, 2024. Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,300,000. During 2024, costs of $2,100,000 were incurred with...

-

Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for B76 Company, considering the following transactions under three different cost allocation methods and using perpetual...

-

Calculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering the following transactions under three different cost allocation methods and using perpetual...

-

A projectile of mass \(m=2.5 \mathrm{~kg}\) is shot tangentially (see Fig.12.19) at the edge of a ring having radius \(R=50 \mathrm{~cm}\) and whose mass is equal (within measurement errors) to that...

-

1. How will you check if a class is a child of another class? 2. What is init method in python?

-

1. What are lists and tuples? What is the key difference between the two? 2. What is Scope in Python?

-

1. What is an Interpreted language? 2. What is a dynamically typed language?

-

Q.1 If denotes increasing order of intensity, then the meaning of the words [talk shout scream] is analogous to [please pander]. Which one of the given options is appropriate to fill the blank? (A)...

-

True or False. To multiply two expressions having the same base, retain the base and multiply the exponents.

-

1. As a general strategy, would you recommend that Carl take an aggressive approach to capacity expansion or more of a wait-and-see approach? 2. Should Carl go with the option for one facility that...

-

Cara, Bob, and Steve want to begin a business on January 1, 2018. The individuals are considering three business formsC corporation, partnership, and S corporation. Cara has investment land with a...

-

Refer to the facts in Comprehensive Problem C:6-54. Now assume the entity is a partnership named Lifecycle Partnership. Additional facts are as follows: ¢ Except for precontribution gains and...

-

Carlos inherits 100 shares of Allied Corporation stock from his father. The stock cost his father $8,000 and had a $25,000 FMV on the date of his fathers death in 2016. The alternate valuation date...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

-

Lime Corporation, with E & P of $500,000, distributes land (worth $300,000, adjusted basis of $350,000) to Harry, its sole shareholder. The land is subject to a liability of $120,000, which Harry...

-

A comic store began operations in 2018 and, although it is incorporated as a limited liability company, it decided to be taxed as a corporation. In its first year, the comic store broke even. In...

Study smarter with the SolutionInn App