Record journal entries for the following transactions of Graphics & Signs. Jan. 1, 2018 Dec. 31, 2018

Question:

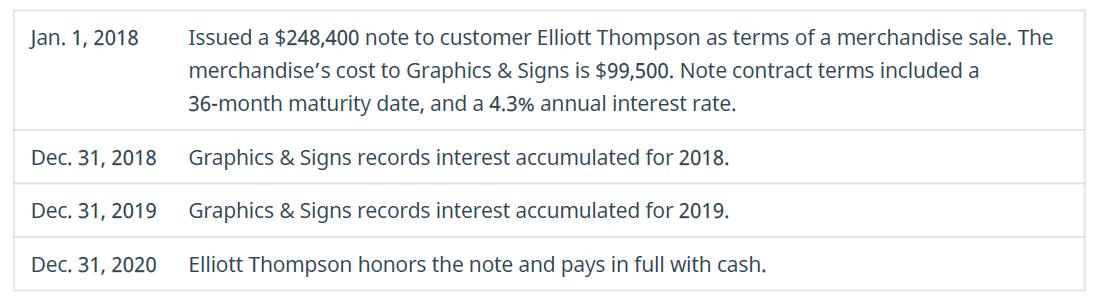

Record journal entries for the following transactions of Graphics & Signs.

Transcribed Image Text:

Jan. 1, 2018 Dec. 31, 2018 Dec. 31, 2019 Dec. 31, 2020 Issued a $248,400 note to customer Elliott Thompson as terms of a merchandise sale. The merchandise's cost to Graphics & Signs is $99,500. Note contract terms included a 36-month maturity date, and a 4.3% annual interest rate. Graphics & Signs records interest accumulated for 2018. Graphics & Signs records interest accumulated for 2019. Elliott Thompson honors the note and pays in full with cash.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 88% (9 reviews)

Jan 1 2018 Debit Accounts Receivable Elliott Thompson 248400 Credit ...View the full answer

Answered By

Hande Dereli

Enthusiastic tutor, skilled in ACT and SAT tutoring. Raised one student's score on the SATs from 1100 combined to 1400. Graduated with a 3.9 GPA from Davidson College and led a popular peer tutoring group for three years. Scored in the top 0.06% in the nation on the SATs. The real reason I'm the one to help you nail the test? Results. Clients invariably praise my ability to listen and communicate in a low-stress, fun way. I think it's that great interaction that lets me raise retest SAT scores an average of 300 points.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Related Video

A journal entry is an act of keeping or making records of any transactions either economic or non-economic. Transactions are listed in an accounting journal that shows a company\'s debit and credit balances. The journal entry can consist of several recordings, each of which is either a debit or a credit

Students also viewed these Business questions

-

Record journal entries for the following transactions of Mason Suppliers. A. Sep. 8: Purchased 50 deluxe hammers at a cost of $95 each from a manufacturer. Credit terms are 5/ 20, n/60, invoice date...

-

Record journal entries for the following transactions of Barrera Suppliers. A. May 12: Sold 32 deluxe hammers at $195 each to a customer, credit terms 10/10, n/45, invoice date May 12; the deluxe...

-

Record journal entries for the following transactions of Furniture Warehouse. A. July 5: Purchased 30 couches at a cost of $150 each from a manufacturer. Credit terms are 2/15, n/30, invoice date...

-

Inscribe a detailed paper on RFID Solutions and Standards in the Transportation Industry.

-

Ellie and Vince are trying to decide whether to purchase a new home. The house they want is priced at $200,000. Annual expenses such as maintenance, taxes, and insurance equal 4 percent of the home's...

-

(a) Use a graphing utility to complete the table. b) Make a conjecture about the relationship between cos (3Ï/2 - θ) and -sin θ. 0 | 0.3 0.6 | 0.9 | 1.2 | 1.5 (#-) sin...

-

4

-

Every firm in the widget industry has fixed costs of $6 and faces the following marginal cost curve: Quantity Marginal Cost 1 ..........$2 2 .......... 4 3 .......... 6 4 .......... 8 5 ..........10...

-

Moorman Corporation reports the following information: Correction of understatement of depreciation expense in prior years, net of tax 430,000 Dividends declared, 2019 320,000 Net income for 2019...

-

1. What situations might have created the budget deficit for the Constantine family? 2. What amounts would you suggest for the various categories for the family budget? 3. Describe additional actions...

-

Dortmund Stockyard reports $896,000 in credit sales for 2018 and $802,670 in 2019. It has a $675,000 accounts receivable balance at the end of 2018, and $682,000 at the end of 2019. Dortmund uses the...

-

Ancient Grains Unlimited has an accounts receivable turnover ratio of 3.34 times. The net credit sales for the year are $567,920. What is the days sales in receivables ratio for 2018 (rounded to the...

-

Victor Holt, the accounting manager of Sexton Inc., gathered the following information for 2006. Some of it can be used to construct an income statement for 2006. Ignore items that do not appear on...

-

Consider: x3 + c (x 1)(x 3)(x + 1) (x + 3x + 9) (x + 2x + 5) How many partial fractions are there in the partial fraction decomposition of this function? How many unknowns (A, B, ...) must be...

-

Hand trace the following program. 1 y 0 2 for x in range (5): y = y + x 4 print ("x",x, "and y =", y) Note: You can shorten the prompts in your hand trace if you want to.

-

Determine the location using physics calculations to solve the problem. Show step by step details for how you solved the problem. I don't need an explanation explaining how to solve the problem. T By...

-

Give a brief explanation about the organization/company i.e., the products or services, number of employees, etc. Do a SWOT chart to help organize your ideas. Refer to resources in the reading for an...

-

How are organization "formal" and "informal" structures impacted in organizational change? Provide some examples. Compare and contrast Lewin's Change Model with Kotter's Change model. (Show how they...

-

Im thinking of a number! It lies between 1 and 10; its square is rational and lies between 1 and 10. The number is larger than . Correct to two decimal places (that is, truncated to two decimal...

-

r = 0.18 Find the coefficients of determination and non-determination and explain the meaning of each.

-

a. What role does intent play in determining whether a transfer is a gift and therefore not subject to the income tax? b. Are tips received by employees from customers ex-cludable from gross income...

-

What is the tax significance of the face amount of a life insurance policy?

-

What conditions must be met for an award to qualify for an exclusion under Sec. 74?

-

The following amounts were reported on the December 31, 2022, balance sheet: Cash $ 8,000 Land 20,000 Accounts payable 15,000 Bonds payable 120,000 Merchandise inventory 30,000 Retained earnings...

-

Sandhill Co. issued $ 600,000, 10-year, 8% bonds at 105. 1.Prepare the journal entry to record the sale of these bonds on January 1, 2017. (Credit account titles are automatically indented when the...

-

Based on the regression output (below), would you purchase this actively managed fund with a fee of 45bps ? Answer yes or no and one sentence to explain why.

Study smarter with the SolutionInn App