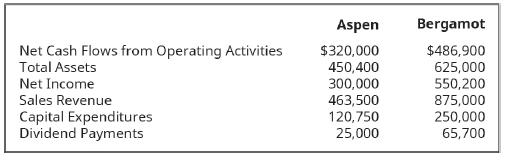

The following shows excerpts from financial information relating to Aspen Company and Bergamot Company. Compute the following

Question:

The following shows excerpts from financial information relating to Aspen Company and Bergamot Company.

Compute the following for both companies. Compare your results.

A. Free cash flow

B. Cash flows to sales ratio

C. Cash flows to assets ratio

Transcribed Image Text:

Net Cash Flows from Operating Activities Total Assets Net Income Sales Revenue Capital Expenditures Dividend Payments Aspen $320,000 450,400 300,000 463,500 120,750 25,000 Bergamot $486,900 625,000 550,200 875,000 250,000 65,700

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (7 reviews)

A Aspen Bergamot Cash Flows from Operating Activities 320000 486900 Cash paid for Capital ...View the full answer

Answered By

Marvine Ekina

Marvine Ekina

Dedicated and experienced Academic Tutor with a proven track record for helping students to improve their academic performance. Adept at evaluating students and creating learning plans based on their strengths and weaknesses. Bringing forth a devotion to education and helping others to achieve their academic and life goals.

PERSONAL INFORMATION

Address: , ,

Nationality:

Driving License:

Hobbies: reading

SKILLS

????? Problem Solving Skills

????? Predictive Modeling

????? Customer Service Skills

????? Creative Problem Solving Skills

????? Strong Analytical Skills

????? Project Management Skills

????? Multitasking Skills

????? Leadership Skills

????? Curriculum Development

????? Excellent Communication Skills

????? SAT Prep

????? Knowledge of Educational Philosophies

????? Informal and Formal Assessments

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax

Question Posted:

Students also viewed these Business questions

-

The following shows excerpts from financial information relating to Stanwell Company and Thodes Company. Compute the following for both companies. Compare your results. A. Free cash flow B. Cash...

-

The following shows excerpts from Camole Companys statement of cash flows and other financial records. Compute the following for the company: A. Free cash flow B. Cash flows to sales ratio C. Cash...

-

Excerpts from Smart Pro Inc.'s statement of cash flows appear as follows: Requirement As the chief executive officer of Smart Pro Inc., your duty is to write the management letter to your...

-

STEELCO manufactures two types of steel (steel 1 and steel 2) at two locations (plant 1 and plant 2). Three resources are needed to manufacture a ton of steel: iron, coal, and blast furnace time. The...

-

There is no (computer) IS in this game. If your team had some money to spend on an IS, what would you buy? In Chapter 5, we discussed five ways an IS can improve a process. For the IS you purchase,...

-

Z-Rox Inc. manufactures office copiers, which are sold to retailers. The price and cost of goods sold for each copier are as follows: Price................................................$890 per...

-

Explain the two concepts emic and etic. How can we handle these issues in crosscultural research?

-

Reporting a Correct Income Statement with Earnings per Share to Include the Effects of Adjusting Entries and Evaluating the Net Profit Margin as an Auditor Tyson, Inc., a party rental business,...

-

The objective of the cost dimension of activity-based management is: a.improving the accuracy of cost assignments. b.increasing the sales of all products. c.reducing the number of trade debtors of a...

-

On December 1, 2020, Cambridge Printers had the account balances shown below. The following transactions occurred during December. Dec. 3 Purchased 4,000 units of inventory on account at a cost of...

-

Which of the following would trigger a subtraction in the indirect operating section? A. Gain on sale of investments B. Depreciation expense C. Decrease in accounts receivable D. Decrease in bonds...

-

Provide the missing piece of information for the following statement of cash flows puzzle. Cash flows from operating activities Cash flows from investing activities Cash flows from financing...

-

Using recent spot exchange rate quotations of the five component currencies (as available in the Wall Street Journal), compute the French franc value of one Special Drawing Right (SDR). Hint: because...

-

Stefney Christian Date: 06/26/2023 To: From: New England Patriot Subject: Analysis of Aircraft Purchase vs. Chartering Decision I've done a thorough analysis of the decision to buy or charter a plane...

-

The Giovonis' monthly income is $9000. The have 14 remaining payments of $269 on a new car and 16 payments of $70 remaining on their living room furniture. The taxes and insurance on the house are...

-

2. Determine the following inverse z-transforms using partial fraction expansion method. a. The sequence is right sided (causal). 1 z 14z 2 + 4z-3 X(z) = 11 1 Z-1 13 + 2-2 8 1 -3 4Z b. The sequence...

-

(4 pts) 1. Find all vertical and horizontal asymptotes of the function f(x) (You do NOT need to show the limit work) 2x2-2 x+4x+3

-

Cherboneau Novelties produces drink coasters (among many other products). During the current year (year 0), the company sold 532,000 units (packages of 6 coasters). In the coming year (year 1), the...

-

Find the exact value of each expression. cos(sin -1 (3/5) - cos -1 1/2)

-

Suppose you won a financial literacy competition and are given FJS10000 to invest, with the condition that investment can be done either in, i) Invest in Unit trust of Fiji or Invest in Fijian...

-

Are creativity and innovation really important to all types of businesses? Is it important to evaluate a creative idea before it becomes an innovation?

-

What is the role of intuition in decision making? Should managers use more objective or subjective intuition techniques when making decisions?

-

When Target deactivated their website, what type of decision did they make? Explain?

-

4 Exercise 9-6 (Algo) Lower of cost or market [LO9-1) 75 Tatum Company has four products in its inventory. Information about the December 31, 2021, Inventory is as follows: oints Product Total Cost...

-

A real estate investment is expected to return to its owner $3,500 per year for 16 years after expenses. At the end of year 16, the property is expected to be sold for $49,000. Assuming the required...

-

You borrowed $15,000 for buying a new car from a bank at an interest rate of 12% compounded monthly. This loan will be repaid in 48 equal monthly installments over four years. Immediately after the...

Study smarter with the SolutionInn App