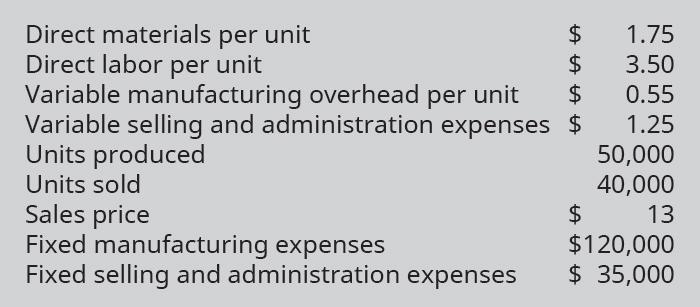

This information was collected for the first year of manufacturing for Wifi Apps: Prepare an income statement

Question:

This information was collected for the first year of manufacturing for Wifi Apps:

Prepare an income statement under variable costing and prepare a reconciliation to the income under the absorption method.

Transcribed Image Text:

Direct materials per unit Direct labor per unit $ Sales price Fixed manufacturing expenses Fixed selling and administration expenses LA LA $ $ Variable manufacturing overhead per unit Variable selling and administration expenses $ Units produced Units sold 1.75 3.50 0.55 1.25 50,000 40,000 13 $ $120,000 $ 35,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (6 reviews)

To prepare an income statement under variable costing and reconcile it to the income under the absorption method for Wifi Apps we need to calculate th...View the full answer

Answered By

User l_998468

I have extensive tutoring experience, having worked as a private tutor for over three years. I have tutored students from different academic levels, including high school, undergraduate, and graduate levels. My tutoring experience has taught me to be patient, attentive to student needs, and effective in communicating difficult concepts in simple terms.

I have a strong background in statistics, probability theory, data analysis, and data visualization. I am proficient in using statistical software such as R, Python, and SPSS, which are commonly used in academic research and data analysis. Additionally, I have excellent communication and interpersonal skills, which enable me to establish rapport with students, understand their learning styles, and adapt my teaching approach to meet their needs.

I am passionate about teaching and helping students achieve their academic goals.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Accounting Volume 2 Managerial Accounting

ISBN: 9780357364802

1st Edition

Authors: OpenStax

Question Posted:

Students also viewed these Business questions

-

The following information was collected for the first year of manufacturing for Appliance Apps: Direct Materials per Unit $2.25 Direct Labor per Unit $1.50 Variable Manufacturing Overhead per Unit...

-

can cause toxicoinfection, symptoms can are diarrhea and can cause acute renal failure and neurological problem. O E.coli O Salmonella O C. botulinum O C. perfringens (

-

Good-Fit Garment Industry was established on July 01, 2018 who is manufacturing and marketing designer garments. After expiry of its first six months operations, the chief executive of the company...

-

Miami Tropical stock has a beta of 1.25. The risk-free rate of return is 4.34 percent and the market risk premium is 9.02 percent. What is the expected rate of return on this stock? 10.23 percent...

-

Top Line Equipment sells hand held engine analyzers to automotive service shops. Top Line Equipment started November with an inventory of 95 units that cost a total of $11,400. During the month, Top...

-

In Exercises evaluate the definite integral. Use a graphing utility to verify your result. X 3 x dx

-

Why might some project team members be reluctant to see the end of a project? AppendixLO1

-

Understanding Tom Penders It was Monday afternoon and Brenda Smith was very excited. She just got off the phone with Tom Penders, the administrator in charge of a large medical office in her...

-

16 Problem 3-13 (Static) Schedules of Cost of Goods Manufactured and cost of Goods Sold; Income Statement [LO3-3) Superior Company provided the following data for the year ended December 31 (all raw...

-

A downside to absorption costing is: A. Not including fixed manufacturing overhead in the cost of the product B. That it is not really useful for managerial decisions C. That it is not allowable...

-

Under absorption costing, a unit of product includes which costs? A. Direct material, direct labor, and manufacturing overhead B. Direct material, direct labor, and variable manufacturing overhead C....

-

What is the difference between segment margin and contribution margin? When would each be used?

-

1. A corn farmer has observed the following distribution for the number of ears of corn per cornstalk. Ears of Corn Probability 1 2 3 4 .3 .4 .2 .1 Part A: How many ears of corn does he expect on...

-

1. A mass m on a vertical spring with force constant k has an amplitude of A. Using the top of the motion as the origin for both gravitational potential energy and spring potential energy: (a) Find...

-

2. Consider the PDE Utt - Uxx + Ut - Ux = 0 (1) for < < and 0

-

On April 1, 2024, Chardonnay pays an insurance company $12,480 for a two- year fire insurance policy. The entire $12,480 is debited to Prepaid Insurance at the time of the purchase. Record the...

-

Which retailer(s) should represent and sell your product?Why?In terms of their range of distribution coverage, is your retailer intensive, selective and exclusive? Why is this aspect important to...

-

The market demand and supply functions for corn are the same as in exercise 15.1. Suppose the government wants to raise the price of corn to $3. What are the welfare effects of a price floor, price...

-

The percentage of completion and completed contract methods are described in the FASB ASC. Search the codification to find the paragraphs covering these topics, cite them, and copy the results.

-

Steele Corp. purchases equipment for $25,000. Regarding the purchase, Steele recorded the following transactions: Paid shipping of $1,000 Paid installation fees of $2,000 Pays annual maintenance...

-

For each of the following transactions, state whether the cost would be capitalized (C) or recorded as an expense (E). A. Purchased a machine, $100,000; gave long-term note B. Paid $600 for ordinary...

-

Ngo Company purchased a truck for $54,000. Sales tax amounted to $5,400; shipping costs amounted to $1,200; and one-year registration of the truck was $100. What is the total amount of costs that...

-

ABC company makes turbo-encabulators, customized to satisfy each customers order. They split overhead into five pools, each with its own activity driver (direct labor for manufacturing, direct labor...

-

Variable manufacturing overhead becomes part of a unit's cost when variable costing is used.Group of answer choicesTrueFalse

-

Santa Fe Corporation has computed the following unit costs for the year just ended:Direct Material used $23Direct Labor $18Fixed selling and administrative cost $18Variable manufacturing overhead...

Study smarter with the SolutionInn App