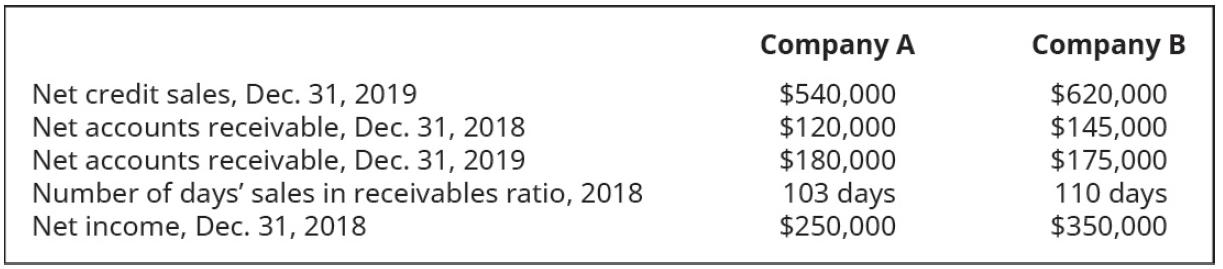

You are considering two possible companies for investment purposes. The following data is available for each company.

Question:

You are considering two possible companies for investment purposes. The following data is available for each company.

Additional Information: Company A: Bad debt estimation percentage using the income statement method is 6%, and the balance sheet method is 10%. The $230,000 in Other Expenses includes all company expenses except Bad Debt Expense. Company B: Bad debt estimation percentage using the income statement method is 6.5%, and the balance sheet method is 8%. The $140,000 in Other Expenses includes all company expenses except Bad Debt Expense.

A. Compute the number of days’ sales in receivables ratio for each company for 2019 and interpret the results (round answers to nearest whole number).

B. If Company A changed from the income statement method to the balance sheet method for recognizing bad debt estimation, how would that change net income in 2019? Explain (show calculations).

C. If Company B changed from the balance sheet method to the income statement method for recognizing bad debt estimation, how would that change net income in 2019? Explain (show calculations).

D. What benefits do each company gain by changing their method of bad debt estimation?

E. Which company would you invest in and why? Provide supporting details.

Step by Step Answer:

Principles Of Accounting Volume 1 Financial Accounting

ISBN: 9781593995942

1st Edition

Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper, OpenStax