a. Calculate the gross margin percentage for each of State Universitys product lines. b. Compare State Universitys

Question:

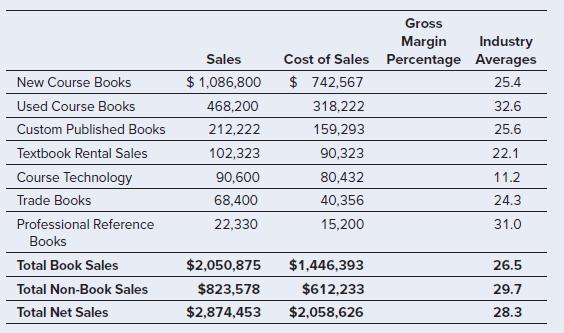

a. Calculate the gross margin percentage for each of State University’s product lines.

b. Compare State University’s gross margins to industry averages. Indicate any margins that appear out of line, in relation to the industry.

Transcribed Image Text:

New Course Books Used Course Books Custom Published Books Textbook Rental Sales Course Technology Trade Books Professional Reference Books Total Book Sales Total Non-Book Sales Total Net Sales Sales $ 1,086,800 468,200 212,222 102,323 90,600 68,400 22,330 $2,050,875 $823,578 $2,874,453 Gross Margin Cost of Sales Percentage $ 742,567 318,222 159,293 90,323 80,432 40,356 15,200 $1,446,393 $612,233 $2,058,626 Industry Averages 25.4 32.6 25.6 22.1 11.2 24.3 31.0 26.5 29.7 28.3

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (14 reviews)

a b The following percentages appear unexpected as we publish New C...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Principles Of Auditing And Other Assurance Services

ISBN: 9781260598087

22nd Edition

Authors: Ray Whittington, Kurt Pany

Question Posted:

Students also viewed these Business questions

-

This financial information is available for Klinger Corporation. Average common stockholders' equity Dividends paid to common stockholders Dividends paid to preferred stockholders Net income Market...

-

Calculate the gross margin percentage of a retailer with annual sales of $5,000,000 and cost of goods sold of $2,000,000. Retailers need merchandise to make sales. In fact, a retailers inventory is...

-

Your comparison of the gross margin percentage for Jones Drugs Ltd for the years 20X1 to 20X4 indicates a significant decline. This is shown by the following information: A discussion with Marilyn...

-

In the United States, the production of ethanol fuel from corn is subsidized. Use bid rent function analysis to suggest what effects this subsidy might be expected to have on land use.

-

Fred Ridgeways project (see Problem 7-25) has progressed over the past several months, and it is now the end of month 16. Fred would like to know the current status of the project with regard to...

-

On 14 August British Biotech traded options were quoted on NYSE Liffe as follows: Assume: No transaction costs. Required a. Imagine you write a December 180 put on 14 August. Draw a graph showing...

-

P 15-4 Apply threshold testsSegment and enterprise-wide disclosure Mer Corporation has five major operating segments and operates in both domestic and foreign markets. Mer is organized internally on...

-

Classify the following reports as being either scheduled or on-demand reports. Cash disbursements listing Overtime report Customer account history Inventory stock-out report Accounts receivable aging...

-

The following data were accumulated for use in reconciling the bank account of Creative Design Co . for August 2 0 Y 6 : Cash balance according to the company s records at August 3 1 , $ 3 2 , 5 6 0...

-

ABC Pty Ltd intends to form a special purpose vehicle (SPV) in Australia. This will involve building new water treatment facilities. ABC Pty Ltd intends to undertake the development of the proposed...

-

What are loss contingencies? How are such items presented in the financial statements? Explain.

-

Describe the additional reporting requirements of Government Auditing Standards.

-

In 2002, Hershey Foods Corporation paid dividends of $1.26 per share to its common stockholders (excluding its Class B Common Stock). The market price of Hersheys common stock on December 31, 2002,...

-

Solve X+1U6x-13x+2-4x+5

-

Summarize the selected poster's design format, such as the color, layout, font style, size, space, and the subject's analysis format. Also, analyze how the study started. Such as background and...

-

Income statement Prior year Current year Revenues 782.6 900.0 Cost of sales Selling costs Depreciation (27.0) (31.3) Operating profit 90.4 85.7 Interest Earnings before taxes 85.4 78.2 Taxes (31.1)...

-

View the video at the slide title "Lab: Social Media Post" at time 28:20. Link:...

-

Write a program ranges.py in three parts. (Test after each added part.) This problem is not a graphics program. It is just a regular text program to illustrate your understanding of ranges and loops....

-

Match the equations with the graphs labeled IVI and give reasons for your answers. Determine which families of grid curves have u constant and which have v constant. x = (1 - u)(3 + cos v) cos 4u, y...

-

What is a content filter? Where is it placed in the network to gain the best result for the organization?

-

Suggest some factors that might cause an audit engagement to exceed the original time estimate. Would the extra time be charged to the client?

-

What problems are created for a CPA firm when audit staff members underreport the amount of time spent in performing specific audit procedures?

-

Why is audit work usually organized around balance sheet accounts rather than income statement accounts?

-

During 2024, its first year of operations, Hollis Industries recorded sales of $11,900,000 and experienced returns of $760,000. Cost of goods sold totaled $7,140,000 (60% of sales). The company...

-

What is the value of a 15% coupon bond with 11% return? Is it a discount or a premium bond?

-

A manufacturer with a December 31 taxation year end sells new machinery for $50,000 on January 2, 2022. The cost of the machinery is $20,000. The terms of the sale require an initial payment of...

Study smarter with the SolutionInn App