It is September 2001. You, CA, have recently been assigned to the audit of the Canadian Chocolate

Question:

It is September 2001. You, CA, have recently been assigned to the audit of the Canadian Chocolate Corp. (CCC). The partner who has just assumed responsibility for the engagement has asked you to prepare a planning memo. The memo is to discuss all significant matters that need to be con¬ sidered in arriving at an audit opinion on the consolidated financial statements for the fiscal year ending December 31, 2001. You have obtained the information set out below.

CCC is a public company whose head office is located in Metrotown, Canada. The company's sole business is the manufacturing of chocolate candy products; it is one of the largest chocolate candy producers in North America. Prior to 2001, it had two Canadian subsidiaries (one located in West¬ ern Canada and the other in Eastern Canada), several sub¬ sidiaries located in the United States, and one in Brazil. All subsidiaries have a December 31 year end.

Head office uses three experienced internal audit teams to perform various internal verification procedures at the sub¬ sidiary locations. For each of the past seven years, the com¬ pany has engaged your firm, Sommer & Friedlan, Chartered Accountants, to render an opinion on the consolidated finan¬ cial statements. In addition, your firm audits each Canadian subsidiary. The U.S. subsidiaries are audited by a national U.S. firm, Marti & Rosti. A local Sao Paulo firm, Carvalho & Frietas, audits the Brazilian operation, which follows the same accounting policies as the Canadian operations.

Products and technology are regularly transferred among the North American enterprises. The subsidiary in Brazil, however, operates as a virtually independent entity because of currency and other government-imposed restrictions. The Brazilian subsidiary's dividend payments are limited to 15 percent of each year's opening retained earnings. The subsidiary's major contribution has been its success to date in ensuring that the cocoa contracts, negotiated with govern¬ ment-controlled corporations in Brazil and neighbouring countries, are filled on time and that the company continues to obtain cocoa beans of high quality.

CCC manufactures 12 chocolate candy products that are retailed in Canada. All subsidiaries are manufacturers, but each foreign location manufactures only 10 products that are marketed in the country. All development and manufactur¬ ing of new products are done by the Canadian companies. New products, although marketed internationally, are not manufactured by the foreign subsidiaries until success in the foreign markets seems assured. All testing of new products is conducted in specific regions in Canada and the United States. Research and development costs are allocated among all companies on the basis of the relative size of their total assets. In addition, there are substantial common costs such as advertising th|t aresallocated on the same basis. Products that have been'successfully launched have usually enjoyed a comfortable level of profitability, recouping the significant start-up costs .(forany special capital equipment, introduc¬ tory advertising campaigns, and other expenditures) within a reasonable period of time.

The chocolate-bar market has a very rigid retail price structure. Cost control is therefore crucial.

The product concentrations of the two main raw-material components, chocolate and sugar, vary from country to country, according to local consumer preferences. The varia¬ tions in mix can cause a variation of up to 5 percent in the total cost of the raw material used for each product brand.

Head office arranges the purchase of all cocoa beans from South American producers; the Brazilian company acts as purchasing agent. Because the prices are quite volatile, CCC obtains all cocoa bean purchases through contracts that fix, in advance, the price for each delivery date. Head office schedules the deliveries direct to each subsidiary on or about April 1 and November 1 each year. The beans are stored in silos at the manufacturing plants.

Sugar is purchased from regional suppliers by each sub¬ sidiary and is also obtained through contracts with antici¬ pated quarterly deliveries. The last delivery date is December 1 each year. The sugar is stored in warehouses adjacent to the bean silos. CCC uses pile rotation procedures to ensure that the oldest sugar is used first. Perpetual inven¬ tory records are maintained at each location to account for changes in the quantity of these two important commodities. CCC does not perform a physical count on these items but adjusts the perpetual records when either a silo or a pile is totally depleted. To arrive at an inventory cost at each quar¬ ter end, CCC uses the contract price of the latest shipment. Head office's accounting policy is to value raw-material inventories at cost unless the replacement cost expressed in the local currency is lower.

Final processing consists of adding and mixing various flavour ingredients to the semi-processed chocolate and refrigerating the product. After 24 hours, the product is cut and wrapped, at which point it is placed in display boxes of 24 bars and sent to the warehouse for shipment. If a product remains unshipped for three months, the wrapping is removed and the bars are shipped to various surplus stores for bulk sale at reduced prices. If the anticipated net realiz¬ able value is below cost, CCC's policies require this inven¬ tory to be written down to the lower amount.

It is common for semi-processed chocolate to be shipped among operating subsidiaries, especially among the U.S. subsidiaries and between the Western Canada subsidiary and Western U.S. subsidiaries. Transfer prices are calculated by head office each time there is a transfer. The subsidiaries' executives are often dissatisfied with the prices.

In the past, CCC has concentrated most of its advertising on the most successful long-established brands. Ten of the twelve products are more than six years old. The "Treat" bar has been the worldwide top seller among all CCC's products for the past 10 years. Its "Chocnut" candies, introduced 14 years ago, have placed third in worldwide CCC's sales in five of the last seven years. In recent times, however, the company has found its overall market share decreasing because of aggressive marketing by its chief competitor. Sweet Corporation. In addition, there have been a number of problems in marketing new products. The last successful launch was six years ago. Products introduced annually since then have failed to sell well enough to cover their start¬ up costs. Only two of these products are still manufactured and will be discontinued if the new "Food for the Modern Adult" line proves successful.

CCC is determined to increase its overall North American market share. Accordingly, the company hired two new advertising agencies (one in Canada and the other in the United States) to conduct the "Food for the Modern Adult" campaign. This is the most ambitious campaign the company has ever mounted to promote new products. Four new prod¬ ucts were launched simultaneously in North America on July 1,2001.

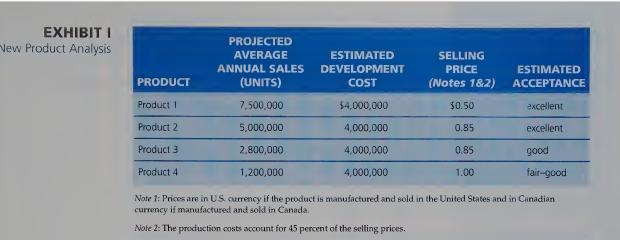

Preliminary analysis of market potential were conducted earlier in the year in several test centres in the United States and Canada. Management has incorporated these analyses in its product projections, presented in Exhibit I on page 311. The United States is expected to account for 75 percent of total sales of the new product line and Canada for 25 percent.

Two new subsidiaries (one in Canada and one in the United States) have been established during 2001 to produce the four products, and all capital programs are complete. A new policy established by head office requires that the two new subsidiaries share all costs related to the four new prod¬ ucts. All costs incurred to date in connection with the new products have, however, been allocated to all the sub¬ sidiaries, including the two new subsidiaries. It is expected that the new subsidiaries will experience a loss this year.

Under the current five-year contracts that commenced on April 1, 2001, with the advertising agencies, head office is committed to spending large sums to advertise the new products. The total contract cost of the U.S. campaign will be US\($2.25\) billion, and the total contract cost of the Canadian campaign will be CAN\($1\) million.

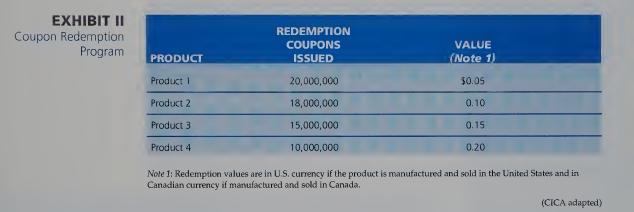

Head office has also arranged for a redeemable coupon campaign. Coupons were mailed to potential customers before June 30, 2001, to coincide with the new product launching. As set out in Exhibit II on page 311, these coupons will provide for a reduction in the selling price of the four products.

In CCC's experience, 5 percent of the coupons will be redeemed within the first year. In the second and subsequent years of such campaigns, it is normal for approximately 1 percent of the total number of coupons issued to be redeemed in each quarter until the expiry date, December 31, 2003. The company will give the retailer US\($0.0175\) or CAN\($0.0175\) per coupon to cover handling charges. The ser¬ vice fee to be paid to the agencies that have agreed to handle the retailers' claims is US\($0.02\) or CAN\($0.02\) per coupon.

Earlier this year, one of the U.S. subsidiaries was the vic¬ tim of an extortion attempt. The extortionists demanded US\($24\) million from the company. When CCC refused to comply, the extortionists carried out their threat to poison "Treat" bars in three large U.S. cities, apparently chosen at random. As a result, six people died and twelve others became seriously ill. The company responded by removing every "Treat" bar from the shelves of all U.S. retailers and destroying the stock. The company also introduced a tamper-proof wrapper for new stock and hired a profes¬ sional public relations firm to undertake a special campaign to rebuild consumer confidence in the bar.

All costs were transferred to the head office to allow for one consolidated insurance claim. The company has esti¬ mated that the total cost resulting from the poisoning is about CAN\($25\) million: \($2\) million for the new wrapping machinery, \($8\) million for the products destroyed, \($2\) million for the public relations firm, and \($13\) million for profits lost through reduced product sales. CCC's insurance covers 80 percent of profits lost through reduced product sales. CCC has informed you that it does not want to include the insur¬ ance settlement in income in the current year but wants to defer and amortize the amount over a five-year term (on the same basis as the costs of machinery and equipment are amortized).

Legal proceedings have been commenced against CCC and its subsidiaries by the estates of the deceased parties and by those who became ill. They are suing for US\($450\) million.

Required Draft the memo for the partner.

Step by Step Answer:

Auditing And Other Assurance Services

ISBN: 9780130091246

9th Canadian Edition

Authors: Alvin Arens, James Loebbecke, W Lemon, Ingrid Splettstoesser