Pamela Albright is the manager of the audit of Stan ton Enterprises Ltd., a public company that

Question:

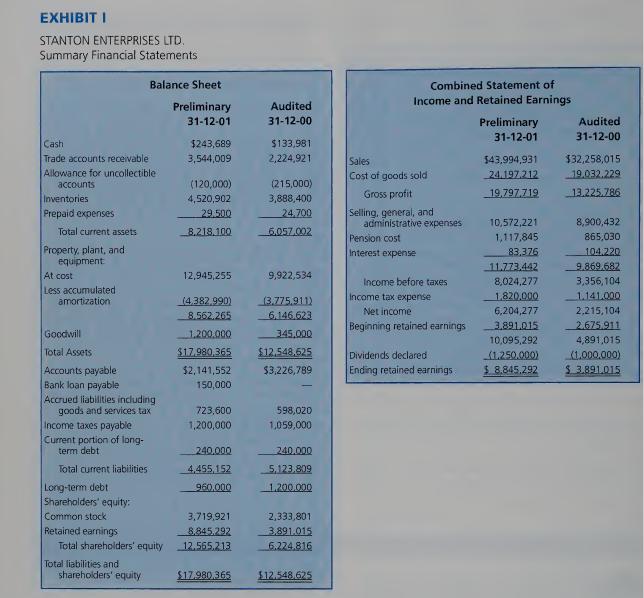

Pamela Albright is the manager of the audit of Stan¬ ton Enterprises Ltd., a public company that manu¬ factures formed steel subassemblies for other manufacturers. Albright is planning the 2001 audit and is considering an appropriate amount for planning materiality, and the appro¬ priate inherent risks. Summary financial statement informa¬ tion is shown in Exhibit I on page 242.

Additional relevant planning information is summarized below:

1. Stanton has been a client for four years and Albright's firm has always had a good relationship with the com¬ pany. Management and the accounting people have always been cooperative, honest, and have had a positive attitude about the audit and financial reporting. No material misstatements were found in the prior year's audit. Albright's firm has monitored the relationship carefully because when the audit was obtained, Leonard Stanton, the CEO, had the reputation of being a "high¬

flyer" and had been through bankruptcy at an earlier time in his career.

2. Leonard Stanton runs the company in an autocratic way, primarily because of a somewhat controlling personality. He believes that it is his job to make all the tough deci¬ sions. He delegates responsibility to others but is not always willing to delegate a commensurate amount of authority.

3. The industry in which Stanton participates has been in a favourable cycle for the past few years, and that trend is continuing in the current year. Industry profits are rea¬ sonably favourable and there are no competitive or other apparent threats on the horizon.

4. Internal controls for Stanton are evaluated as reasonably effective for all cycles but not unusually strong. Although Stanton supports the idea of control, Albright has been disappointed that management has continually rejected Albright's recommendation to establish an inter¬ nal audit function.

5. Stanton has a contract with its employees that if earnings before taxes, interest expense, and pension cost exceed $7.8 million for the year, an additional contribution must be made to the pension fund equal to 5 percent of the excess.

Required

a. You are to play the role of Pamela Albright in the Decem¬ ber 31, 2001, audit of Stanton Enterprises Ltd. Make a preliminary judgment of materiality. Prepare a working paper showing your calculations.

b. Make an audit risk decision for the current year as high, medium, or low, and support your answer.

c. Perform analytical procedures for Stanton Enterprises Ltd. that will help you identify accounts that may require additional evidence in the current year's audit. Docu¬ ment the analytical procedures you perform and your conclusions. (Note: The financial statements are available on CD-ROM.)

d. The evidence planning spreadsheet to decide tests of details of balances for Stanton's accounts receivable is shown in Exhibit II. Use the information in the case and your conclusions in parts

(a) to

(c) to complete the fol¬ lowing rows of the evidence planning spreadsheet: Audit risk, Inherent risk, and Analytical procedures. Also fill in tolerable misstatement at the bottom of the spreadsheet. Make any assumptions you believe are reasonable and appropriate, and document them.

Step by Step Answer:

Auditing And Other Assurance Services

ISBN: 9780130091246

9th Canadian Edition

Authors: Alvin Arens, James Loebbecke, W Lemon, Ingrid Splettstoesser