a. Analysis and evaluation: What concerns, if any, are raised by the evidence noted above? Assuming that

Question:

a. Analysis and evaluation: What concerns, if any, are raised by the evidence noted above? Assuming that the problems found in the sample are representative of problems in the population, determine any relevant amount of projected misstatement based on your finding, assuming that the ratio of misstatements to book value found in the strata from which they were selected are representative of the entire strata. After considering your findings, what additional audit procedures should be performed, if any?

b. Evaluation: What issues do you want to discuss with management? Draft the issues that you want to discuss with CIRI management, including with whom in management discussions should be held.

When obtaining an understanding of the accounting system, you looked at the file containing the exception reports reviewed by Dennis Brewer (e.g., for items billed but not received). While these reports are printed daily, often only three or four reports would be present for a given week. Dennis said that he really pays attention to the reports primarily on Wednesday and Thursday and that he often does not keep the reports from earlier in the week.

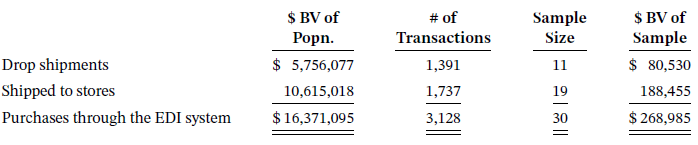

Subsequently, you pulled a sample of 30 transactions from the EDI system to perform substantive tests of transactions and test the accuracy of recorded transactions that are processed through the system.

Of the 30 transactions selected at random, 19 represented transactions shipped directly to stores, and 11 represented drop shipments. The following table summarizes the nature of this sample of 30.

You noted the following issues among the 30 transactions.

? You find one item that shipped directly to the stores with an invoice total of $9,775, for which the price on the invoice per the purchase order was $67 per unit but was billed at $76 per unit. The company purchased 100 units of the SKU number on that invoice and paid the invoice in full as billed.

? The company was closed from Thursday, June 30, 2022, through Monday, July 4, 2022. Inventory was taken on Thursday, June 30, 2022. During the inventory count, a truck came in with a shipment from CWS. The value of the invoice was $9,875. The units were segregated from the rest of the inventory and not counted. At the end of the inventory, the shipment was added to the overall value of the inventory. During the closing of the books after July 4, the purchase was recorded as an account payable in the amount of $9,875 with a date of June 30, 2022.

? Auditing drop shipments has been a problem in past audits, as CIRI has not always had receiving documents to support deliveries to construction sites. However, your firm has been able to verify that shipments had been billed to customers and subsequently cash was received associated with these deliveries.

In the current year, not only did you verify that the item was supported by electronic receiving reports, but you also followed up to find that they were billed to customers who paid for the goods. All 11 of the electronic invoices from CWS for drop shipments included in the sample were supported by electronic receiving reports and they were paid in the correct amounts and on time. However, Dennis could not show where one transaction with an invoice amount of $4,323 had been billed to, and had been paid by, customers. He suggested two possibilities. First, he suggested that some customers had prepaid for the shipments. Second, he complained that he often had to follow up with the stores about filing receiving reports because someone at the store level failed to file a shipping report. However, his primary responsibility was only for the purchasing system, not the billing system and ensuring that vendors were paid on time. He could not verify what caused the problem with this transaction. Further follow-up failed to identify the underlying sales invoice for this transaction.

Step by Step Answer:

Auditing A Practical Approach with Data Analytics

ISBN: 978-1119401742

1st edition

Authors: Raymond N. Johnson, Laura Davis Wiley, Robyn Moroney, Fiona Campbell, Jane Hamilton