After performing an audit, the auditor determines that 1. The financial statements of a corporation are presented

Question:

After performing an audit, the auditor determines that

1. The financial statements of a corporation are presented fairly.

2. A company's receiving department is inefficient.

3. A company's tax return does not conform with IRS regulations.

4. A government supply depot is not meeting planned program objectives.

5. The financial statements of a physician are properly prepared on a cash basis.

6. A foreman is not carrying out his assigned responsibilities.

7. The IRS is in violation of an established government employment practice.

8. A company is meeting the terms of a government contract.

9. A municipality's financial statements correctly show actual cash receipts and disbursements.

10. The postal service in midtown is inefficient.

11. A company is meeting the terms of a bond contract.

12. A department is not meeting the company's prescribed policies concerning overtime work.

Required

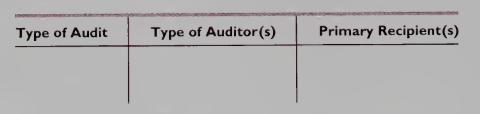

a. Indicate the type of audit that is involved: (1) financial, (2) compliance, or (3) operational.

b. Identify the type of auditor that is involved: (1) independent, (2) internal, (3) government-GAO, or (4) government-IRS.

c. Identify the primary recipient(s) of the audit report: stockholders, management. Congress, and so on. Use the following format for your answers:

Step by Step Answer: