By 2010, Ernst & Young (EY; E&Y) had served as the independent audit firm for Universal American

Question:

By 2010, Ernst & Young (EY; E&Y) had served as the independent audit firm for Universal American Corporation for 15 years. Universal, a large healthcare services company headquartered in affluent Westchester County, 20 miles north of New York City, was a valued and high profile audit client of the Big Four firm. Universal's stock traded on the New York Stock Exchange, and the company claimed membership in the prestigious Fortune 500, which includes the 500 largest U.S. companies based upon annual revenues.

Despite Ernst & Young's long tenure as Universal's auditor, for several years, the relationship between the audit firm and the company's senior executives had been strained. Among the Universal executives who had "expressed dissatisfaction"1 with Ernst & Young was Robert Waegelein, the company's longtime chief financial officer (CFO). Waegelein was very familiar with the nature and purpose of independent audits since he had been employed as an auditor by KPMG, rising to the rank of senior audit manager before leaving to become Universal American's CFO in 1990.

The relationship between Ernst & Young and Universal had deteriorated to the point that in early 2010, a company executive confided in an Ernst & Young representative that the company was "considering changing audit firms." To salvage the client relationship, Ernst & Young replaced the entire Universal audit team in May 2010. The audit firm installed Gregory Bednar as the new "lead" or "coordinating" partner of the Universal engagement. Bednar was a well-respected audit partner known for having strong interpersonal skills. The 50-year-old Bednar had joined the firm in 1982 shortly after graduating from a small liberal arts college in the Midwest.

Ernst & Young's decision to replace the Universal audit team apparently persuaded the company's audit committee to retain the firm as its independent auditor.

A senior Ernst & Young partner had recommended Bednar be placed in charge of the Universal engagement. This senior partner told Bednar "at the outset that [Universal] was a 'troubled account,' which meant Bednar understood his responsibilities would include 'developing' and 'mending' EY's relationship with [Universal]." While focusing on the "relationship piece" of the engagement, Bednar assigned the "day-to-day oversight" responsibilities for the Universal audits and quarterly reviews to other senior members of the audit team who reported to him.

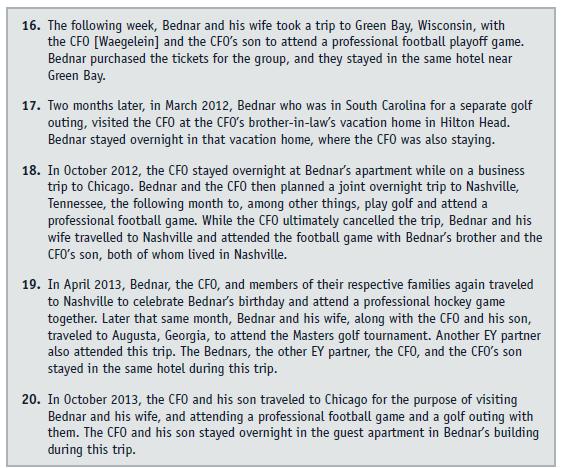

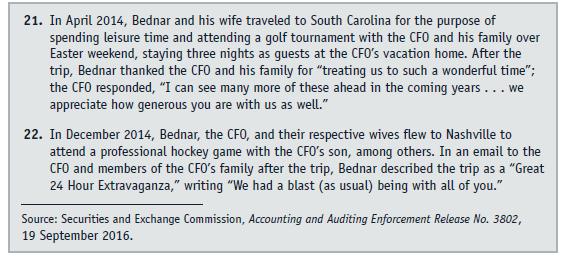

The Securities and Exchange Commission (SEC) reported that "soon after" being placed in charge of the Universal engagement, Bednar "began entertaining" Robert Waegelein, the most important client contact person for the Ernst & Young audit engagement team. By early 2012, Bednar had “developed a close personal relationship” with Waegelein, a relationship the SEC characterized as being “inappropriate for an independent auditor and a CFO” of a public company.

Over the next three years, Bednar dedicated considerable time, effort, and expense to extending and strengthening his friendship with Waegelein and members of Waegelein’s family.

Questions

1. In AAER No. 3802, the SEC referred to the "reasonable investor" benchmark embedded in the agency's "general standard" of auditor independence. Identify the complete text of the latter standard and the four "principles" that the SEC relies on to "measure" auditor independence. Compare and contrast the SEC's view of auditor independence with the auditor independence requirements included in the AICPA Code of Professional Conduct.

2. Should auditors' "entertainment expenses" be billed to audit clients? Defend your answer. In your response, refer to the entertainment expenses incurred by Gregory Bednar in his role as the coordinating partner on Ernst & Young's Universal American audit team.

3. How, if at all, might Gregory Bednar's "close personal relationship" with Robert Waegelein have adversely impacted Ernst & Young's Universal American audits?

4. Do you believe it was appropriate for Ventas executives to be involved in choosing the coordinating audit partner for the Ventas audit team? Defend your answer. What potential risks did that involvement pose for Ernst & Young, Ventas, and the individual ultimately chosen to serve as the coordinating partner?

5. Ventas disclosed the reason why it replaced Ernst & Young as its independent audit firm. Do you believe that Universal American should have disclosed the nature of the Bednar-Waegelein relationship and the related SEC investigation that preceded its change in auditors? Defend your answer.

Step by Step Answer: