In your audit of the financial statements of Scotia Corporation at December 31, 19X1, you observe the

Question:

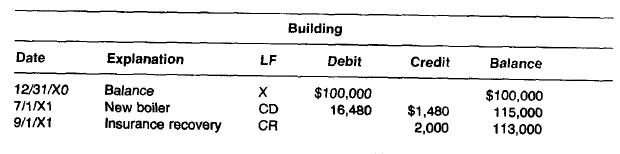

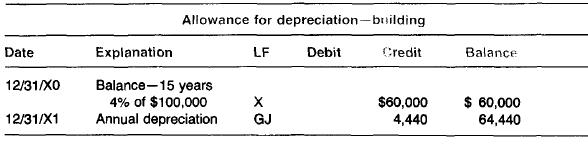

In your audit of the financial statements of Scotia Corporation at December 31, 19X1, you observe the contents of certain accounts and other pertinent information as follows:

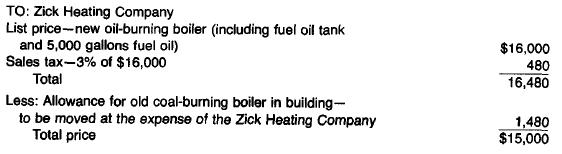

You learn that on June 15 the company's old high-pressure boiler exploded. Damage to the building was insignificant, but the boiler was replaced by a more efficient oil-burning boiler. The company received $2,000 as an insurance adjustment under terms of its policy for damage to the boiler. The disbursement voucher charged to the building account on July 1, 19X1 is shown below:

In vouching the expenditure, you determine that the terms included a 2 percent cash discount, which was properly computed and taken. The sales tax is not subject to discount. Your audit discloses that a voucher for $1,000 was paid to Tourmaline Company, on July 2, 19X1, and charged to the repair expense account. The voucher is adequately supported and is marked "installation costs for new oil-burning boiler." The company's fuel oil supplier advises the fuel oil had a market price of 16 cents per gallon on July 1 and 18 cents per gallon on December 31. The fuel oil inventory at December 31 was 2,000 gallons. A review of subsidiary property records discloses that the replaced coal-burning boiler was installed when the building was constructed and was recorded at a cost of $10,000. According to the manufacturers of the new boiler, it should be serviceable for 15 years. In computing depreciation for retirements, Scotia Corporation consistently treats a fraction of a month as a full month. Prepare the adjusting journal entries that you would suggest for entry on Scotia's books. The books have not been closed. Support your entries with computations in good form.

Step by Step Answer:

Auditing Concepts And Methods A Guide To Current Auditing Theory And Practice

ISBN: 9780070099999

5th Edition

Authors: Mcgraw-Hill