Sioux Valley Rural Electric Power Cooperative issues books of sight drafts to the foremen of its 10

Question:

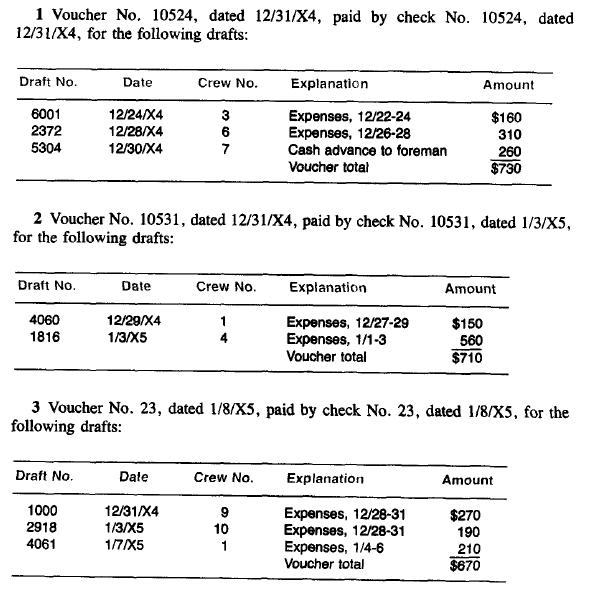

Sioux Valley Rural Electric Power Cooperative issues books of sight drafts to the foremen of its 10 field crews. The foremen use the drafts to pay the expenses of the field crews when they are on line duty requiring overnight stays. The drafts are prenumbered and, as is clearly printed on the drafts, are limited to expenditures of \($300\) or less. The foremen prepare the drafts in duplicate and send the duplicates, accompanied by the expense reports substantiating the drafts, to the general office. The draft duplicates are accumulated at the general office, and a voucher is prepared when there are two or three draft duplicates on hand. The voucher is the authority for issuing a company check for deposit in an imprest fund of \($5,000\) maintained at a local bank to meet the drafts as they are presented for payment. The cooperative maintains a separate general ledger account for the imprest fund. The audit of the voucher register and cash disbursements disclosed the following information pertaining to sight drafts and the reimbursement of the imprest fund: 1 Voucher No. 10524, dated 12/31/X4, paid by check No. 10524, dated 12/31/X4, for the following drafts:

4 All the above vouchers were charged to travel expense.

5 Examination of the imprest fund's bank statement for December, the January cutoff bank statement, and accompanying drafts presented for payment disclosed the following information:

a. Reimbursement check No. 10524 was not credited on the December bank statement.

b. The bank honored draft No. 2372 at the established maximum authorized amount.

c. Original 19X4 drafts drawn by foremen but not presented to the client's bank for payment by 12/31/X4 totaled \($1,600.\) This total included all 19X4 drafts itemized above except No. 4060 and No. 2372, which were deducted by the bank in December.

d. December bank service charges listed on the December bank statement but not recorded by the client amounted to \($80.\)

e. The balance per the bank statement at December 31, 19X4, was \($5,650.\)

1. Prepare the auditor's adjusting journal entry to correct the books at December 31, 19X4. (The books have not been closed.) A supporting work paper analyzing the required adjustments should be prepared in good form.

2. Prepare a reconciliation of the balance per bank statement and the financial statement figure for the imprest cash account. The first figure in your reconciliation should be the balance per bank statement.

Step by Step Answer:

Auditing Concepts And Methods A Guide To Current Auditing Theory And Practice

ISBN: 9780070099999

5th Edition

Authors: Mcgraw-Hill