The Landa Manufacturing Company was incorporated and began business on January 1, 19X3. It has been successful

Question:

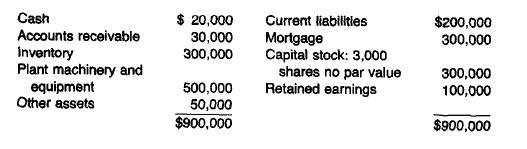

The Landa Manufacturing Company was incorporated and began business on January 1, 19X3. It has been successful and now requires a bank loan for additional working capital to finance expansion. The bank has requested an audited statement for the year ended December 31, 19X6. The company has not had an audit made in prior years. You have been retained to audit the financial statements. The following is the condensed balance sheet as of November 30, 19X6:

Your audit disclosed the following facts:

1. The company started a job cost system in 19X6. Prior to that time no unit costs are available. The inventory includes 100 units of certain finished goods. manufactured prior to January 1, 19X6, estimated to cost \($50,000,\) and component parts for an additional 100 units estimated to cost \($25,000\) in labor, material, and overhead. Sales during 19X6 were 20 units at \($850\) each. Management informs you that they overestimated the market for these items but that eventually they will recover the cost by sale of the units. However, your investigation discloses that this particular unit has been superseded by a more efficient model, and there is reason to question the optimism of management regarding the salability of the units on hand. The inventory value was estimated, since no cost records were maintained. You made tests in an effort to establish the validity of the cost estimates, but were unable to do so. The balance of the inventory consists of items manufactured or acquired during 19X6. Application of generally accepted auditing procedures established that this portion of the inventory is properly priced at the lower of cost or market on the first-in, first-out method. 2 On June 26, 19X6 the board of directors granted options to certain officers and employees for the purchase of 500 shares of unissued capital stock at \($100\) per share. The options may be exercised at any time prior to December 31, 19X8. No stock has been issued under these options.

a. Do any of these matters require disclosure in the financial statements or explanation in the auditor's report? Give reasons for your conclusion in each case.

b. If disclosure or explanation is required, prepare a note or paragraph for use in your audit report.

Step by Step Answer:

Auditing Concepts And Methods A Guide To Current Auditing Theory And Practice

ISBN: 9780070099999

5th Edition

Authors: Mcgraw-Hill