You are engaged as the auditor for an employees' profitsharing pension trust which has been in existence

Question:

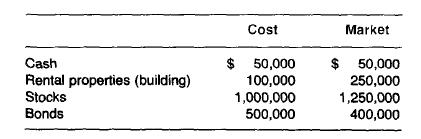

You are engaged as the auditor for an employees' profitsharing pension trust which has been in existence for a number of years. Each qualified employee has an equity in the trust which the employee is entitled to receive when he leaves the company. The membership of participating employees changes each year because additional employees qualify while others are retired. The amount of equity received varies with length of service from zero for the first 5 years up to 100 percent with 10 years of service. The trust agreement does not state how the fund's assets should be valued. The trust's assets consist of the following:

1 You are requested to give the trustees your recommendations for the valuation of the trust's assets in audited financial statements and the reasons for your recommendations.

2. Would your opinion be a standard report, or would you vary it, and if so, how?

3. The trustees inform you that the trust has entered into a 10-year lease on the rental property. The trust is to receive annual rents of $21,000 for 10 years, and the lessee has the option to purchase the building for $125,000 at the end of the lease. The lessee has installed an expensive air-conditioning system and has expended substantial sums for remodeling and modernization. The trustees would like your recommendations for valuing the building in the accounts this year and in the future, and your suggestions for the proper accounting entries to record the yearly $21,000 payments.

4. What disclosure, if any, of the lease should be made in the financial statements?

Step by Step Answer:

Auditing Concepts And Methods A Guide To Current Auditing Theory And Practice

ISBN: 9780070099999

5th Edition

Authors: Mcgraw-Hill