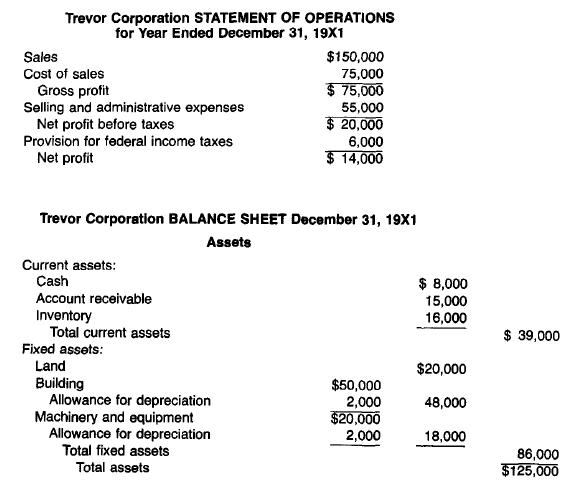

The Trevor Corporation commenced doing business on January 1, 19X1. It pro- duces one product, which is

Question:

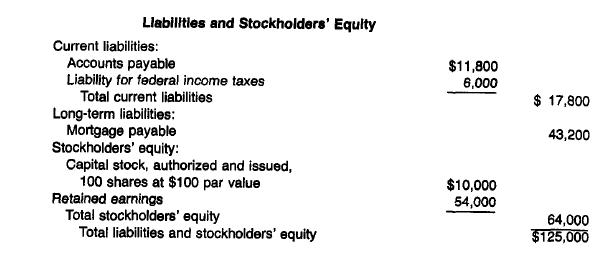

The Trevor Corporation commenced doing business on January 1, 19X1. It pro- duces one product, which is sold to a single customer, Redford Corporation. R. Redford is president of both corporations and owns all the outstanding stock except for a few qualifying shares. You have been the CPA for Redford for some years and accepted the engagement of auditing the Trevor financial statements that appear on page 527. Management cooperated in every respect during the audit. You did not confirm the account receivable. All other generally accepted auditing procedures were followed, and no items of importance were revealed by the audit except the following:

1 The selling and administrative expenses included R. Redford's salary of \($35,000.\)

2. The client had made a \($1,000\) write down to adjust the finished goods inventory to the lower of average cost or market.

3. Land, building, machinery, and equipment are recorded at current market values determined as of January 1, 19X1 by a qualified appraiser. R. Redford purchased the assets from Redford at net book value and contributed them as part of the investment in Trevor. The net book values on the records of Redford were-

4. Depreciation was computed on the straight-line method.

5. The mortgage payable is the balance due on a 10-year, 5 percent, \($48,000\) mortgage payable to the First National Bank in equal annual installments. The mortgage is secured by the company's fixed assets and is guaranteed by Redford.

6. The company customarily contracts for raw materials on a quarterly basis. An audit of post-balance-sheet events revealed that the quarterly raw material contract for the first quarter of 19X2 calls for a price increase of 10 percent.

7. The sales prices to Redford Corp. were approximately 25 percent above competitive prices.

8. Inventory and liability representation letters were signed by Redford. (Disregard the income tax problems arising from the intercorporate relationship and the control by a single stockholder.)

1. State briefly the adjustments you would suggest that the client make to the financial statements. Formal journal entries are not required.

2. Prepare the notes that you would suggest for the financial statements.

3. Assuming that the client adopts your suggested adjustments and notes and that a statement of cash flows is also appropriately presented, prepare the auditor's report. The first two paragraphs should be omitted. If your report is in any way modified or qualified, give your reasons.

Step by Step Answer:

Auditing Concepts And Methods A Guide To Current Auditing Theory And Practice

ISBN: 9780070099999

5th Edition

Authors: Mcgraw-Hill