Thursday, October 24, 1929, easily ranks as the most dramatic day that Wall Street has ever seen.1

Question:

Thursday, October 24, 1929, easily ranks as the most dramatic day that Wall Street has ever seen.1 That day witnessed the beginning of the Great Stock Market Crash that over the following few years would result in an almost 90 percent decline in the Dow Jones Industrial Average (DJIA). Although not nearly as dramatic as "Black Thursday," September 15, 2008, is a date that modern day Wall Street insiders will not soon forget. On that day, one of Wall Street's iconic investment banking firms, Lehman Brothers, filed for bankruptcy. That bankruptcy filing ended the proud history of a firm that had played a major role in shaping the nation's securities markets and economy for more than a century.Lehman Brothers had approximately $700 billion in assets when it failed, which makes it the largest corporate bankruptcy in U.S. history, easily surpassing the previous headline-grabbing bankruptcies of Enron, General Motors, and WorldCom. By comparison, the telecommunications giant WorldCom, which temporarily held the title of the nation's largest business failure after collapsing in 2002, had less than one sixth the total assets claimed by Lehman Brothers.The shocking announcement that Lehman had filed for bankruptcy caused the DJIA to plunge more than 500 points within a few hours. That large loss was only a harbinger of things to come. Within six months, the DJIA had declined more than 50 percent from its all-time high of 14,164.53 that it had reached on October 9, 2007. That market decline wiped out nearly 10 trillion dollars of "paper" wealth for stock market investors and plunged the U.S. and world economies into what became known as the Great Recession.

In the spring of 2010, the Lehman bankruptcy once again captured the nation's attention when the company's court-appointed bankruptcy examiner released his 2,200-page report. In preparing the highly anticipated report, the bankruptcy examiner and his staff reviewed 20 million documents and 10 million emails and spent $38 million. The massive report documented the circumstances and events that had contributed to Lehman's collapse and the parties that the bankruptcy examiner believed could be held civilly liable for it.The release of the bankruptcy report prompted a public outcry because it revealed that Lehman's executives had routinely used multibillion-dollar "accounting motivated" transactions to embellish their company's financial data.Allegedly, those transactions had been executed for the express purpose of enhancing a financial ratio that regulatory authorities, stock market analysts, and investors considered to be a key indicator of the company's overall financial condition.As the company's financial health was rapidly deteriorating in 2007 and 2008, Lehman's executives had ramped up their use of the controversial transactions, resulting in the company's liabilities being understated by as much as $50 billion.Arguably most shocking was that Lehman never disclosed or referred to those transactions in the 10-K and 10-Q registration statements it filed periodically with the Securities and Exchange Commission (SEC).Another revelation in the bankruptcy report that stunned the public was the fact that Lehman's audit firm had been aware of the billion-dollar transactions the company had used to window dress its financial statements. According to the bankruptcy examiner, the Big Four audit firm had discussed those transactions on many occasions with company officials but had not insisted or, apparently, even suggested that the company disclose them in their financial statements or the accompanying notes.The bankruptcy examiner also maintained that the audit firm had not properly informed Lehman's management and audit committee of an internal whistleblower's allegations that management was intentionally misrepresenting the company's financial statements. Because of alleged professional malpractice, Lehman's audit firm was among the parties the bankruptcy examiner suggested could be held civilly liable for the enormous losses suffered by the company's stockholders and creditors.

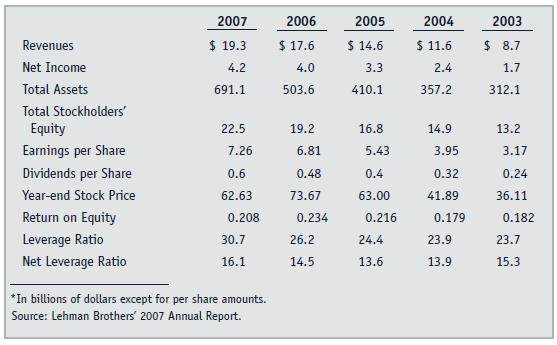

Questions1. When Lehman was developing its Repo 105 accounting policy, did E&Y have a responsibility to be involved in that process? In general, what role should an audit firm have when a client develops an important new accounting policy? Comment on an audit firm's responsibilities during and following that process.2. Do you agree with the assertion that "intent doesn't matter" when applying accounting rules? That is, should reporting entities be allowed to apply accounting rules or approved exceptions to accounting rules for the express purpose of intentionally embellishing their financial statements or related financial data? Defend your answer.3. Do auditors have a responsibility to determine whether important transactions of a client are "accounting-motivated"? Defend your answer.4. William Schlich implied that E&Y's British affiliate had the responsibility for reviewing the legal opinion issued by a British law firm regarding the treatment of Repo 105s as sales of securities. Do you believe that Schlich or one of his subordinates should have reviewed that letter? Why or why not? In general, how should the responsibility for different facets of a multinational audit be allocated between or among the individual practice offices involved in the engagement? 5. Lehman's net leverage ratio was not reported within the company's audited financial statements but rather in the company's financial highlights table and MD&A section of its annual report. What responsibility, if any, do auditors have to assess the material accuracy of financial data included in those two sections of a client's annual report?6. The Repo 105 transactions reduced Lehman's net leverage ratio from 17.8 to 16.1 at the end of fiscal 2007. Do you believe that was a "material difference"? Why or why not?7. In general, what responsibility do auditors have to investigate whistleblower allegations that relate to the material accuracy of an audit client's financial statements?8. E&Y was a defendant in Lehman-related lawsuits filed in both state and federal courts. Identify the factors that influenced E&Y's legal exposure between lawsuits filed in state courts versus those filed in federal courts.

Step by Step Answer: