10. Luzon's Earnings and Global Taxation. All MNEs attempt to minimize their global tax liabilities. Return to...

Question:

10. Luzon's Earnings and Global Taxation. All MNEs attempt to minimize their global tax liabilities. Return to the original set of baseline assumptions and answer the following questions regarding Luzon's global tax liabilities.

a. What is the total amount-in U.S. dollars--which Luzon is paying across its global business in cor- porate income taxes?

b. What is Luzon's effective tax rate on a global basis (total taxes paid as a percentage of pre-tax profits)?

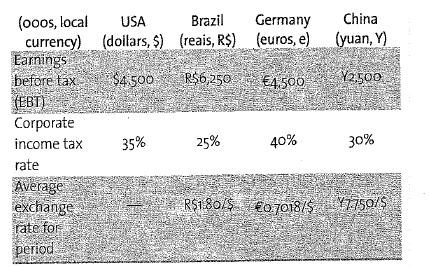

c. What would be the impact on Luzon's EPS and global effective tax rate if Germany instituted a corporate tax reduction to 28%, and Luzon's earnings before tax in Germany rose to 5,000,000? Luzon is a U.S.-based multinational manufacturing firm, with wholly owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Luzon is traded on the NASDAQ. Luzon currently has 650,000 shares outstanding. The basic operating char- acteristics of the various business units is as follows:

Step by Step Answer:

Fundamentals Of Multinational Finance

ISBN: 9780321541642

3rd Edition

Authors: Michael H. Moffett, Arthur I. Stonehill, David K. Eiteman