6. Luzon Corporation's Consolidated Earnings. Luzon must pay corporate income tax in each country in which it

Question:

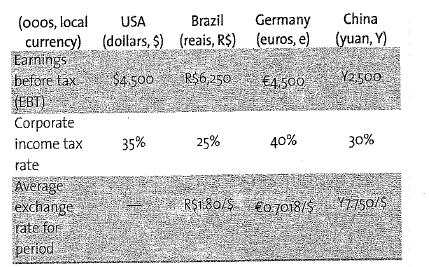

6. Luzon Corporation's Consolidated Earnings. Luzon must pay corporate income tax in each country in which it currently has operations.

a. After deducting taxes in each country, what are Luzon's consolidated earnings and consolidated earnings per share in U.S. dollars?

b. What proportion of Luzon's consolidated earn- ings arise from each individual country?

c. What proportion of Luzon's consolidated earn- ings arise from outside the United States? Luzon is a U.S.-based multinational manufacturing firm, with wholly owned subsidiaries in Brazil, Germany, and China, in addition to domestic operations in the United States. Luzon is traded on the NASDAQ. Luzon currently has 650,000 shares outstanding. The basic operating char- acteristics of the various business units is as follows:

Step by Step Answer:

Fundamentals Of Multinational Finance

ISBN: 9780321541642

3rd Edition

Authors: Michael H. Moffett, Arthur I. Stonehill, David K. Eiteman