8. Stevenson-Kwo's Cost of Equity. Senior manage- ment at Stevenson-Kwo is actively debating the implications of diversification

Question:

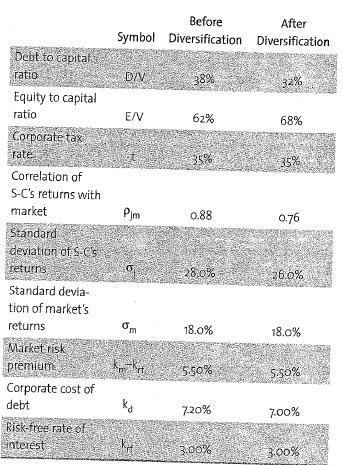

8. Stevenson-Kwo's Cost of Equity. Senior manage- ment at Stevenson-Kwo is actively debating the implications of diversification on its cost of equity. Although both parties agree that the company's returns will be less correlated with the reference market return in the future, the financial advisers

believe that the market will assess an additional 3.0% risk premium for "going international" to the basic CAPM cost of equity. Calculate Stevenson- Kwo's cost of equity before and after international diversification of its operations, with and without the hypothetical additional risk premium, and comment on the discussion.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals Of Multinational Finance

ISBN: 9780321541642

3rd Edition

Authors: Michael H. Moffett, Arthur I. Stonehill, David K. Eiteman

Question Posted: