(Insuring a portfolio with options) Portfolio insurance describes a position in which an investor buys put options...

Question:

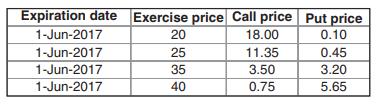

(Insuring a portfolio with options) Portfolio insurance describes a position in which an investor buys put options to insure that the value of his portfolio does not fall below a certain point. Suppose Jerry has a portfolio that consists of 100 shares of RTY stock. The current market price of RTY is $35 per share. The following options are also traded on RTY stock:

a. What options must Jerry buy if he wants to insure that the value of his portfolio will not drop below $2,000?

b. How much will this “insurance” cost?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi

Question Posted: