(Intrinsic value vs. BlackScholes value) Consider the data below. a. Produce a graph comparing a calls intrinsic...

Question:

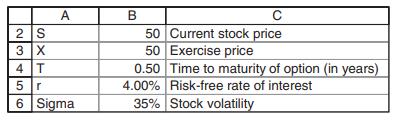

(Intrinsic value vs. Black–Scholes value) Consider the data below.

a. Produce a graph comparing a call’s intrinsic value (defined as Max(S – X, 0)) and its Black–Scholes price for S = 20, 25, . . ., 70.

From this graph you should be able to deduce that it is never optimal to exercise early a call priced by the Black–Scholes.

b. Produce the same graph comparing a put’s intrinsic value (= Max(X – S, 0)) and its Black–Scholes price. From this graph you should be able to deduce that it is may be optimal to exercise early a put priced by the Black–Scholes formula.

Step by Step Answer:

Related Book For

Principles Of Finance Wtih Excel

ISBN: 9780190296384

3rd Edition

Authors: Simon Benninga, Tal Mofkadi

Question Posted: